In this brief blog and video, I will outline why we started buying stocks on March 18, after being in mostly cash on the way down. A few key items:

1/ We did not predict any market bottom, because we don’t make market calls or predictions, we trade what is on the screen.

2/ We are still not making a market call of a low or not, or making any predictions.

3/ Markets are constructive here, but any outcome is always possible. Markets have been strong for the last few days, but can correct or pullback at any time. We continue to expect high volatility in the near term.

4/ We have taken partial profits in some positions, and move dup stops in some other, so our risk exposure is minimal if markets turn back down.

5/ We are more focused on individual charts and the stocks and markets that we are in, and not making broad index calls.

6/ We have stayed focused on our process – reactive, price based analysis of the current charts, with key price levels and moving averages. We have not been focused on health care news, economic news, or trying to predict the future based on a past index chart. We don’t make equity decisions based off the bond market, or copper or anything else. Just price.

YOUTUBE VIDEO FOR THIS BLOG:

On March 14, in our Members Weekly Trend Report, we outlined our written plan to start to put money back to work in the stock market, after having been in mostly cash all the way down, starting at $SPX 3200. https://bluechipdaily.com/we-went-risk-off-when-spx-broke-3200-heres-why/

On March 19, before markets opened, we posted for our Members our “Blue Chip Top 25 Recovery Ideas” with our best longer-term recovery names, across all industries, including tech, energy, staples and pharma, plus more.

On March 26, we published a detailed Public Blog discussing that in the 2008 Bear Market, 196 S&P 500 stocks put in their lows before the market itself bottomed 5 months later, in March 2009.

Having personally traded through the 2000 and 2008 major Bear Markets, I knew from experience that the leading stocks put in their lows before the broad market. https://bluechipdaily.com/its-a-market-of-stocks-196-s7p-stocks-that-bottomed-in-q4-2008/

FROM OUR MEMBERS BLOG, MARCH 14 AND MARCH 19 POSTS

OUR MARCH 26 PUBLIC BLOG

FROM OUR MARCH 14, WEEKLY TREND REPORT, OUR WRITTEN PLAN TO START BUILDING LONGER-TERM POSITIONS, IN DOMINANT NAMES, ON A SCALE IN BASIS, WITH CAREFULLY PRE-DEFINED RISK;

Our focus:

Dominant industry leaders

Our best technical ideas

Pre-defined position risk and overall account risk

Scaled up to currently at 6 open positions, all profitable

Our plan was simple, we knew the importance of having a rules-based plan to start to add exposure, the first buy after having no equity exposure is the tester, but making that first step is important, not only for investment capital, but for the right mindset.

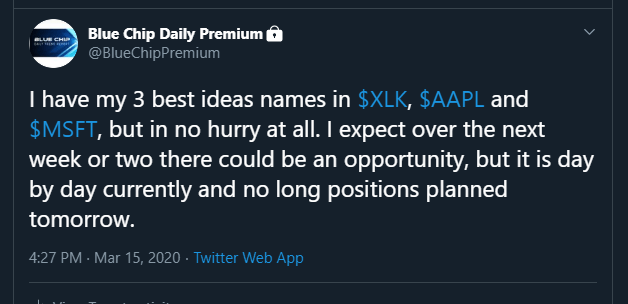

MARCH 15, DIALED IN TO THE CORE NAMES

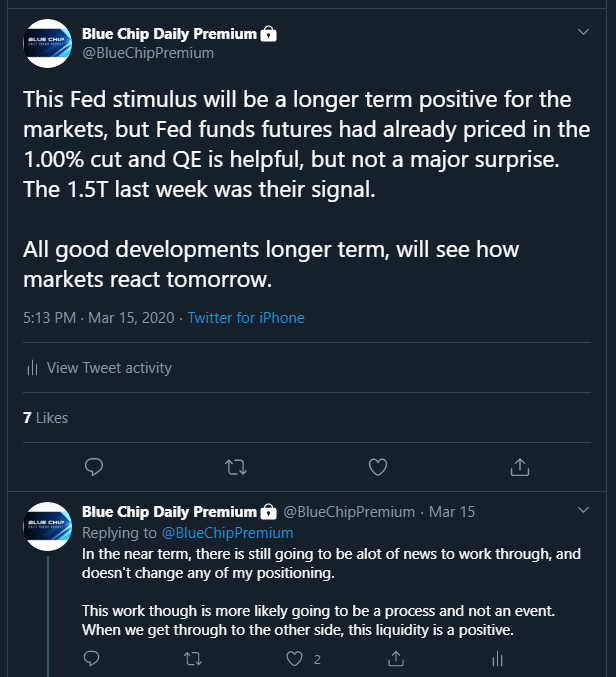

MARCH 15, NOTING FED STIMULUS BENEFITS

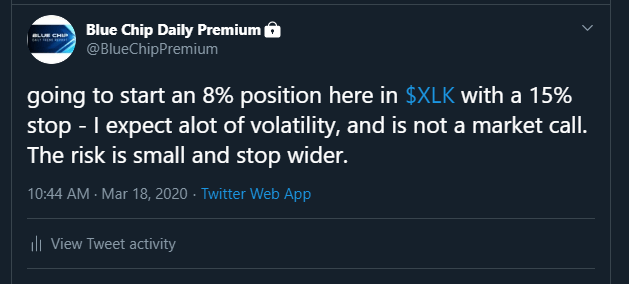

MARCH 18, FIRST OPENING POSITION, IN OUR FOCUS GROUP, MEGA CAP TECH – SMALLER POSITION, WIDER STOP

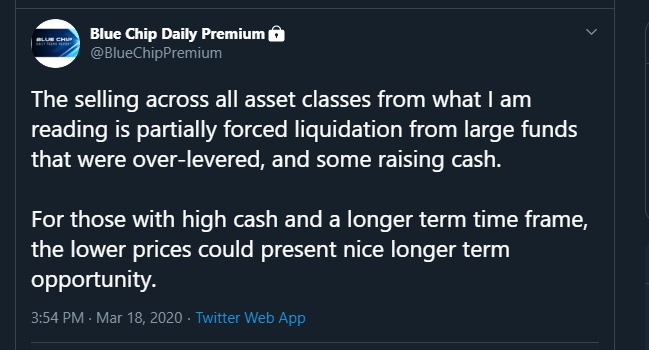

MARCH 18, SEEING OPPORTUNITIES IN THE FORCED SELLING

MARCH 19, OUR MEMBERS ONLY BLOG AND VIDEO

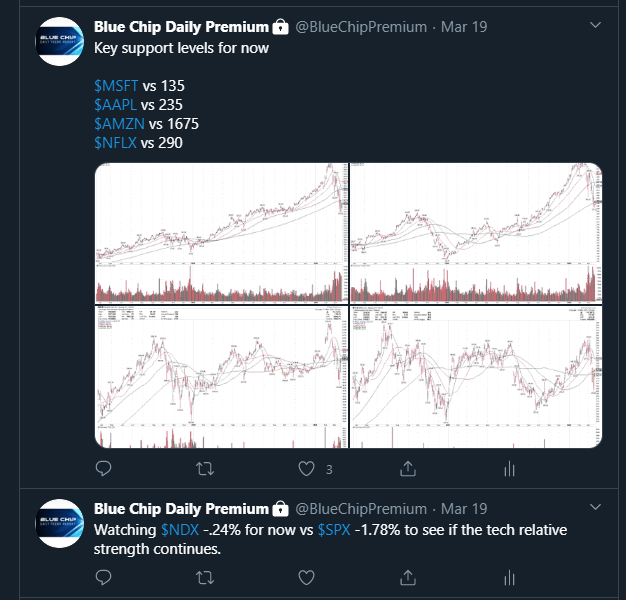

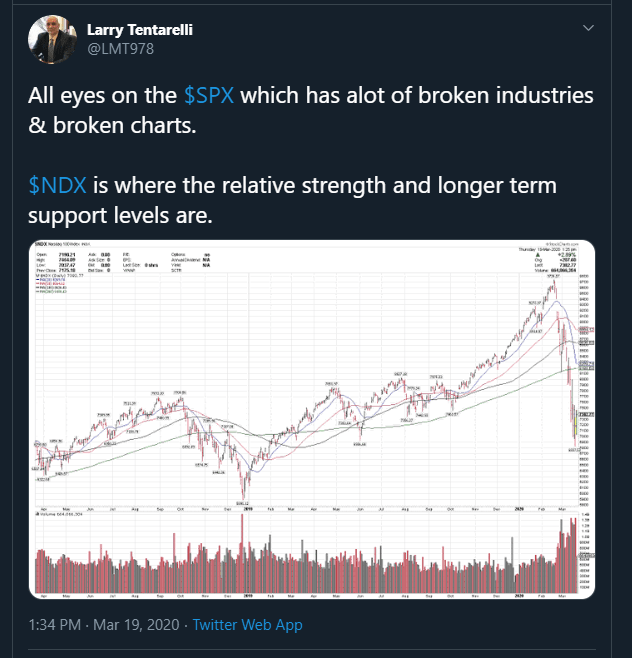

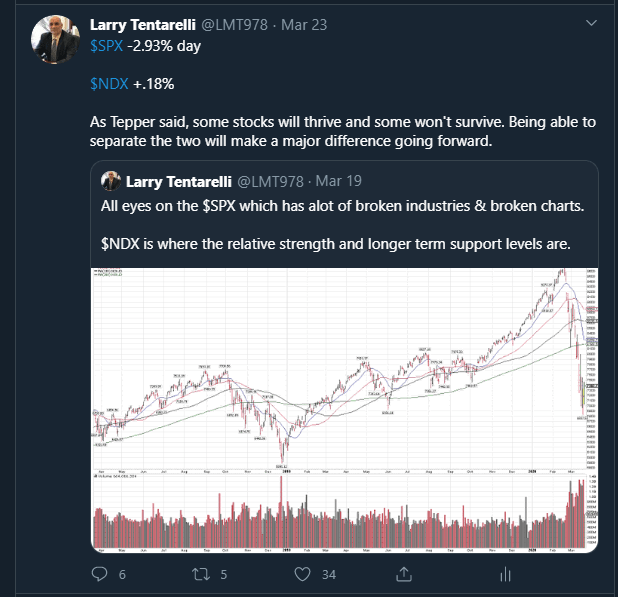

MARCH 19, FOCUSED ON TECH RELATIVE STRENGTH

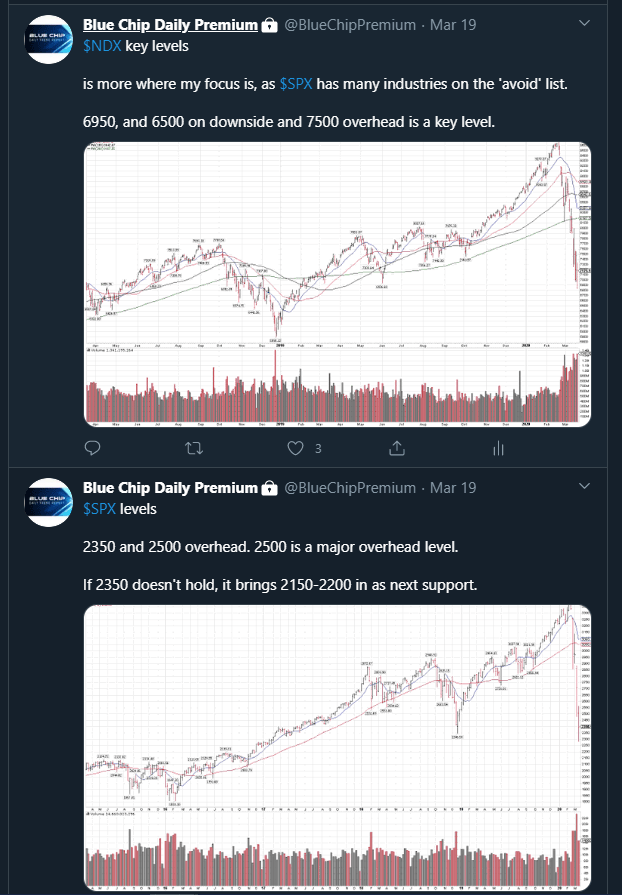

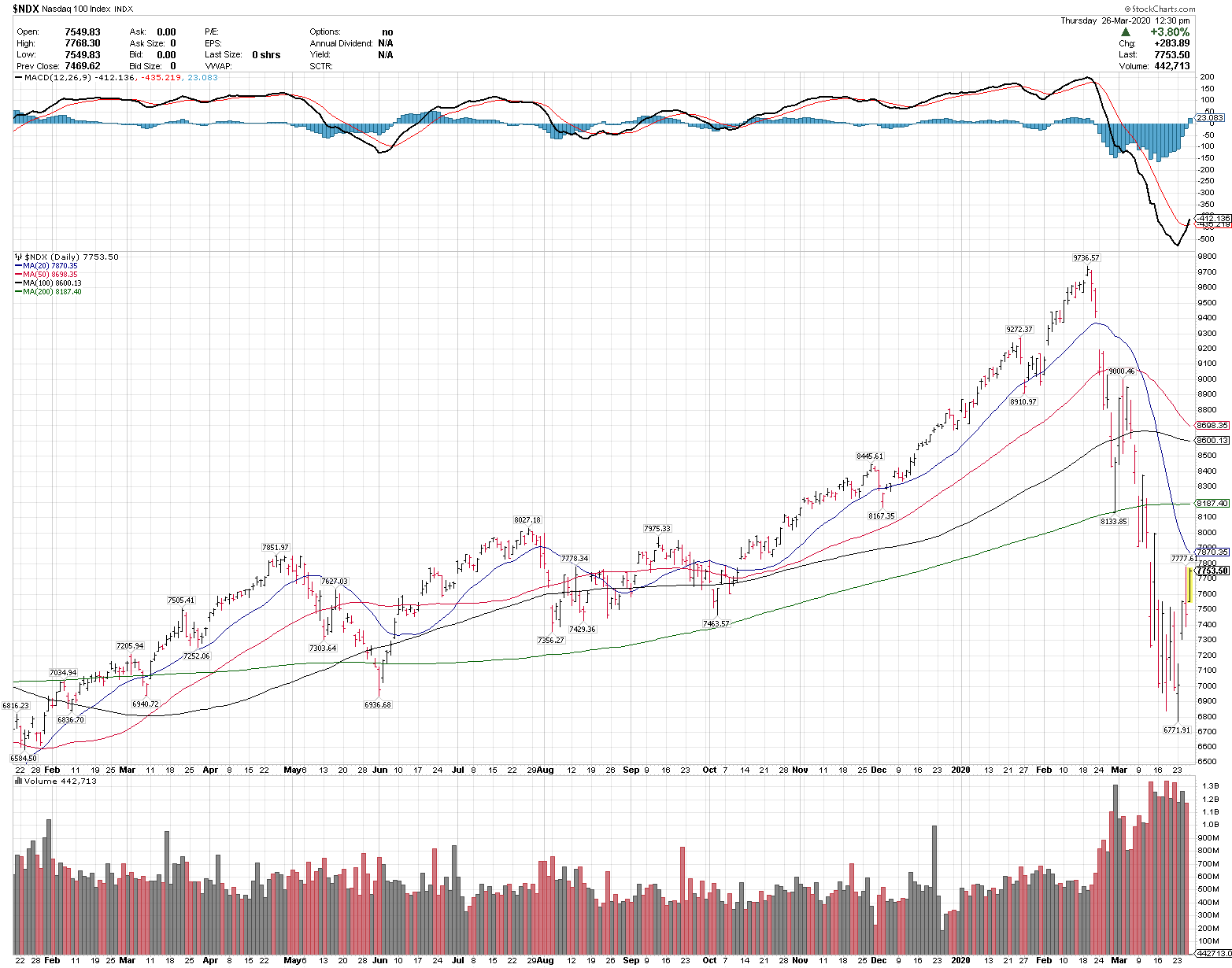

MARCH 19, $NDX TECHNICAL LEVELS, THE CURRENT LOW CAME IN AT 6771.91, IN THE MIDDLE OF OUR RANGE.

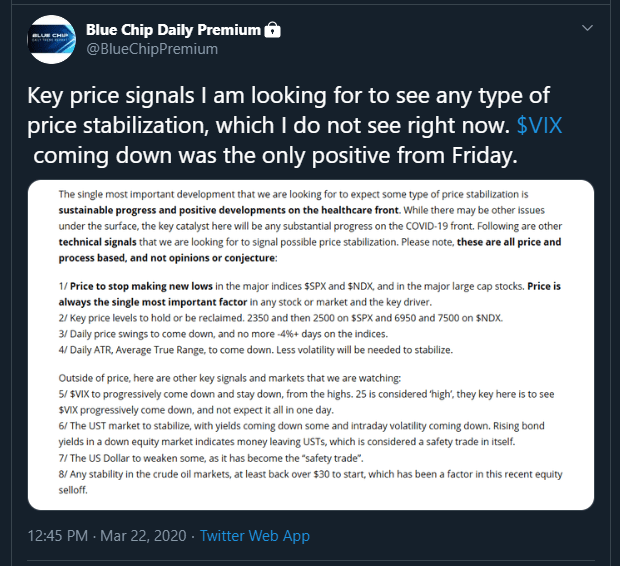

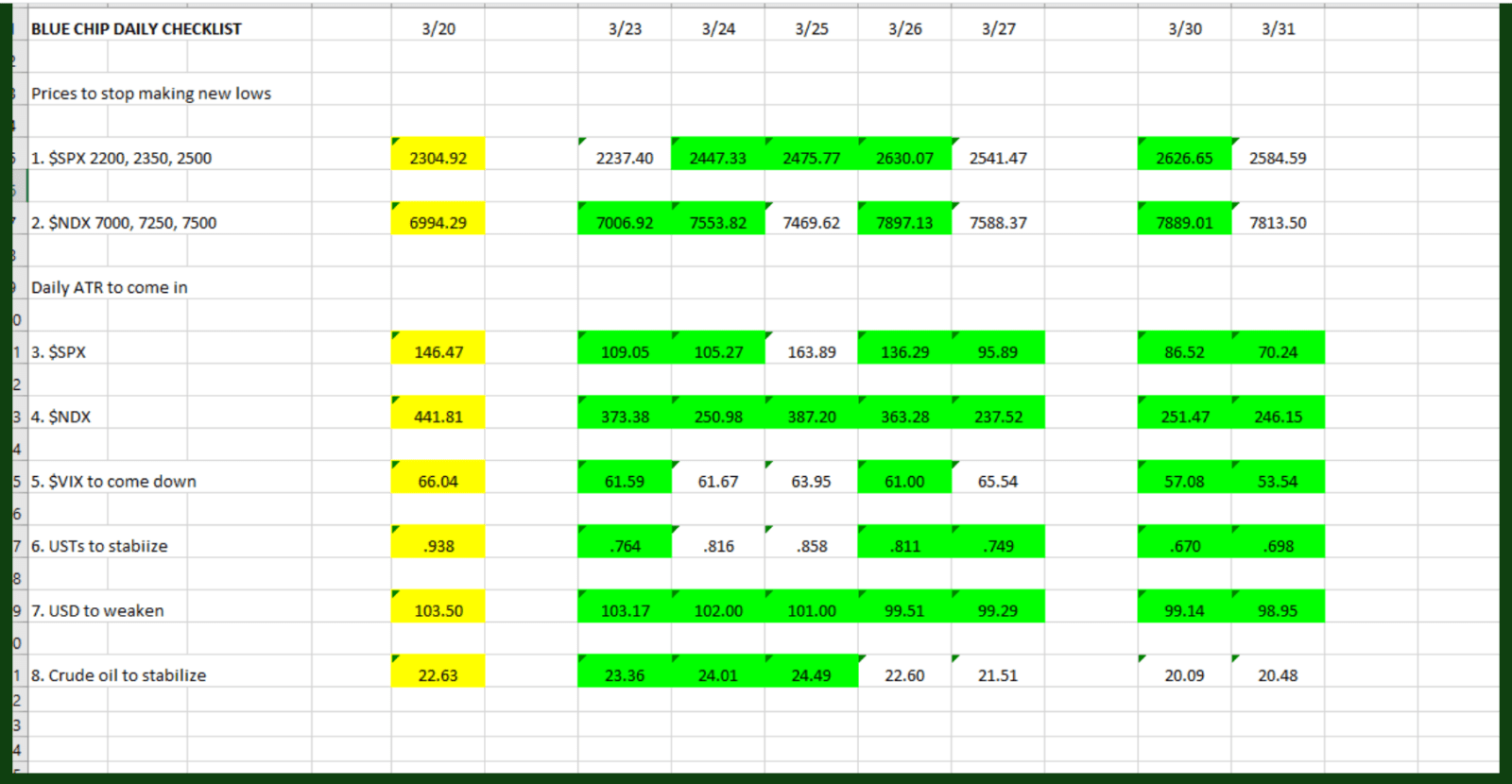

MARCH 22, KEY PRICE SIGNALS AND DATA THAT WE TRACKED

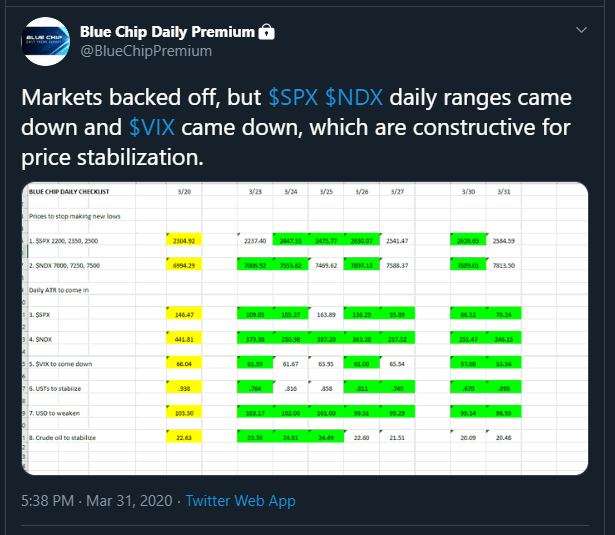

MARCH 31, OUR DAILY DATA TRACKING SHEET

OUR PROPRIETARY DATA TRACKING SHEET

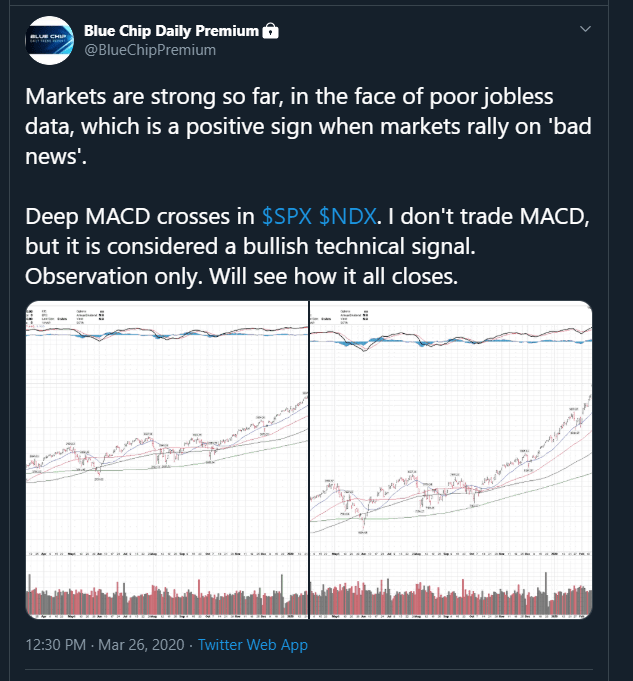

MARCH 26, TECHINCAL SIGNALS

MARCH 26. MACD CROSS

A FEW PUBLIC POSTS

MARCH 19

MARCH 20

MARCH 23

MARCH 27

IN SUMMARY

We did not ‘call the top’, because we don’t make market calls, but we were positioned correctly.

We did not call the bottom, but so far we have been positioned correctly.

We continue to focus on the current charts, and following the same consistent, rules-based process, without making any predictions or market calls.

We are not calling a final low here or not, but we do have open positions, all of which are profitable and will continue to manage the process from here.