Sign up to gain insider access.

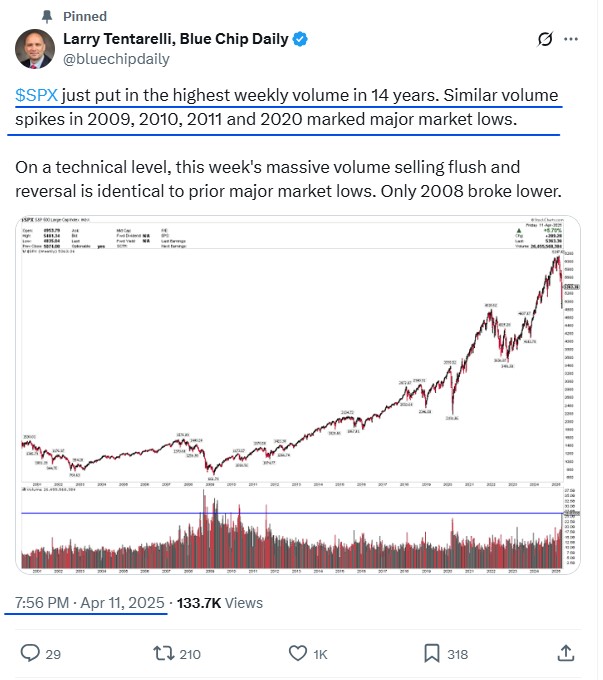

In May, 2023, Larry Tentarelli posted on his Twitter page that the Artificial Intelligence (AI) move was just getting started. We were positioned long in AI stocks and (QQQ) ahead of the late May/early June 2023 breakout move. While many in the media were labeling AI as a bubble, we shared our technical views that the move was just getting started. This is before many triple digit moves in the group, including Nvidia (NVDA).

Intraday SMS alerts (for U.S. numbers), email notification & X/Twitter updates of all portfolio activity, both buys and sells, with stop loss levels and position sizing. All of our open positions are tracked on our members website, 24/7.

Exclusive access to our Premium Members-only X (formerly Twitter) feed. Market coverage starting at 8:30 AM. Timely, need to know information and top technical ideas for that day, actionable at the market. Real-time intra-day buy and sell ideas, with charts through the day.

Our top actionable technical idea coming into the day, posted and emailed every market day, pre-market.

After the close, a 15-minute video, Monday - Thursday. Every Sunday morning a 25 minute video. Our detailed markets recap for the day/week, plus a review of open positions and actionable best ideas.

Posted every Sunday, plus video chart review. Our top 25 large cap ideas, going into the week, considered actionable at the market. Updated weekly. We cover over 900 large cap stocks and all S&P 500 sectors.

High-momentum, breakout potential, high-growth stocks. Ideal for more active traders and investors. 10-15 small/mid cap and/or growth stocks, all market caps. Updated weekly.

Ideal for more conservative investors. Lower volatility, high dividend and defensive stocks. 10-15 large caps. Updated weekly.

10-20 of our top ranked ETFs, across all markets. Updated weekly.

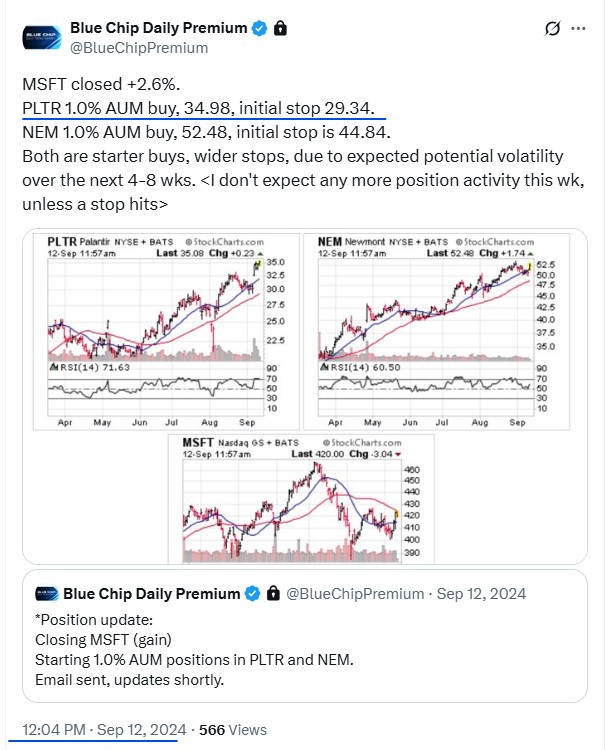

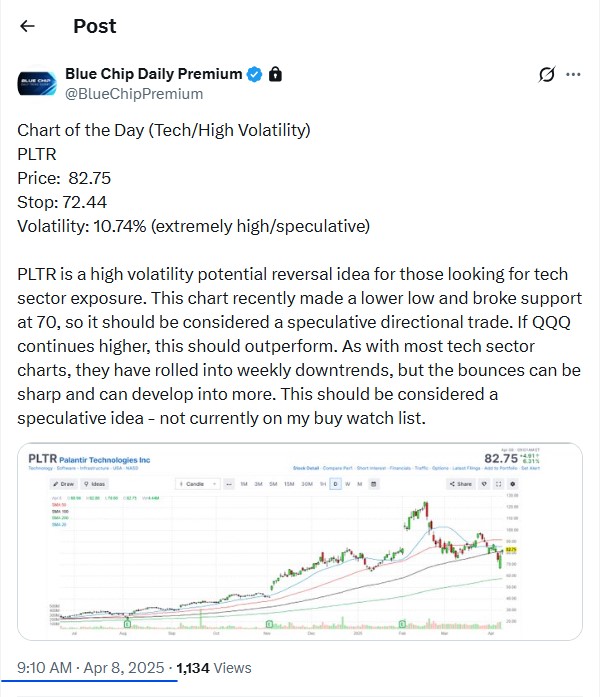

PLTR is +439% since our first buy, on 9/12/24. PLTR has been a repeat Chart of the Day idea. It has also been on multiple weekly Top 25 Stocks Lists since then. Data as of 12/28/25.

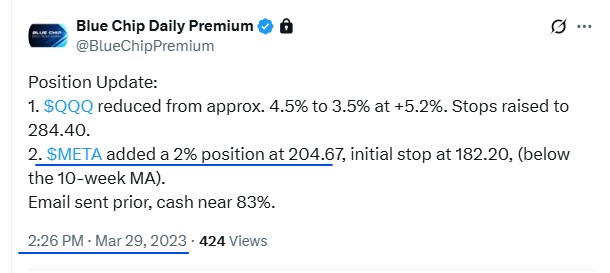

META is +224% since our March 2023 buy. We have also booked some gains along the way. Data as of 12/28/25.

XME is +50.6% since our Buy Alert on 7/10/25. We have also booked some gains along the way. The metals and mining sectro has been on our best ideas list and in our open positions since July 2025. Data as of 12/28/25.

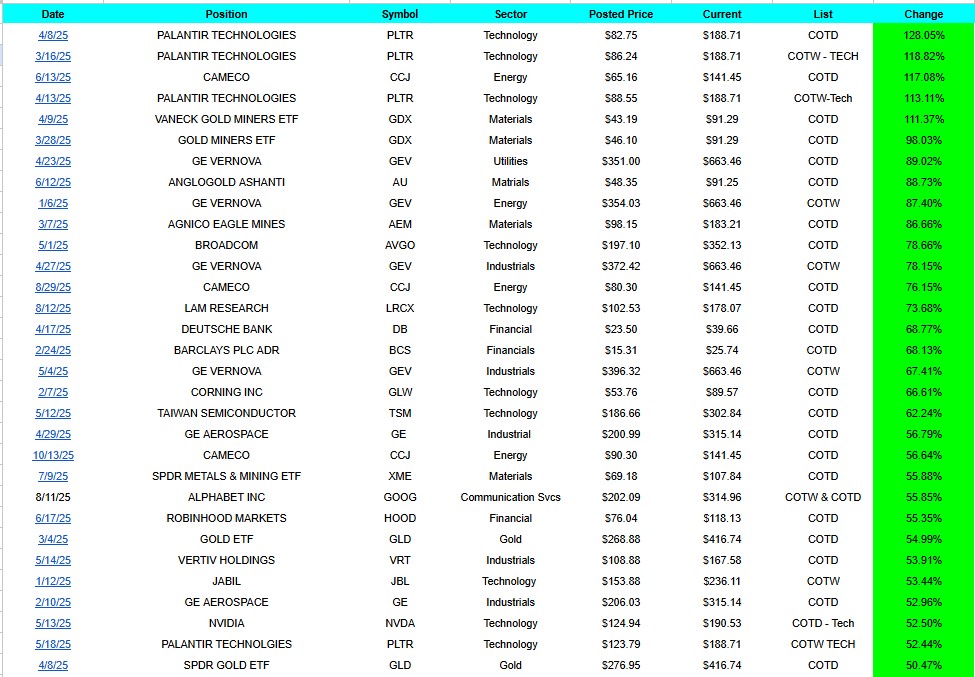

In 2025, we have 30 posted Chart of the Day or Chart of the Week ideas that are currently up from 50% to 128%. Data as of 12/28/25. Each Chart of the Day idea is tracked 24/7 on our members website, above.

In 2025, we have 30 posted Chart of the Day or Chart of the Week ideas that are currently up from 50% to 128%. Data as of 12/28/25. Each Chart of the Day idea is tracked 24/7 on our members website, above.

The bottom 10 performers were all stopped out at an average of – 16.1%.

Sent Monday-Thursday, after the market close, and Sunday afternoon, via email and posted on our members website, plus 24/7 access to our premium X/Twitter Feed.

Our core universe covers over 900+ global large cap leaders, such as Apple, Amazon, Bank of America, Caterpillar, Exxon Mobil, Eli Lilly, Freeport McMoran, Google, Home Depot, J.P. Morgan Chase, Merck, Meta Platforms, Microsoft, Nvidia, Palantir, Tesla, Visa, and Wal Mart, among others, and 90 core macro, index and sector ETF’s across a variety of markets.

January 2026

– Select Open Position

– SPDR Metals & Mining ETF (XME) +55% from our 7/10/25 buy.

Larry Tentarelli is our Chief Technical Strategist and Founder. Larry has built a following of over 90,000 daily readers on our public Twitter page since 2013. He has a lengthy, public track record of consistent and accurate major market calls, including calling the March 2020 market lows and early bullish calls on Artificial Intelligence (AI) in May 2023.

Larry has been actively involved in markets as an investor and trader since 1998. He was a Series 7 licensed advisor with Merrill Lynch, before making the move to research and develop a proprietary technical investing and trading process. Larry passed the FINRA series 65 exam in December 2019.

Larry has been named “One of the Top 50 Twitter accounts for investors to follow” by Dow Jones Marketwatch.

and professional investors and fund managers, RIA’s, financial media analysts and journalists, and individual investors.

“We follow a disciplined, consistent, technical process with a key focus on price, charts and trends. We find it is much more profitable to be on the right side of major market trends, instead of trying to trade against them.”

This site uses functional cookies and external scripts to improve your experience.

Privacy settings

Privacy Settings

This site uses functional cookies and external scripts to improve your experience. Which cookies and scripts are used and how they impact your visit is specified on the left. You may change your settings at any time. Your choices will not impact your visit.

NOTE: These settings will only apply to the browser and device you are currently using.

Cookies

We use cookies to make Blue Chip Daily’s website a better experience. Cookies help to provide a more personalized experience and web analytics for us. Click here to view our Privacy Policy and Terms and Conditions.