BELOW IS A FOLLOW UP TO ONE OF MY MOST READ BLOGS

TODAY’S UPDATE 1/09/20

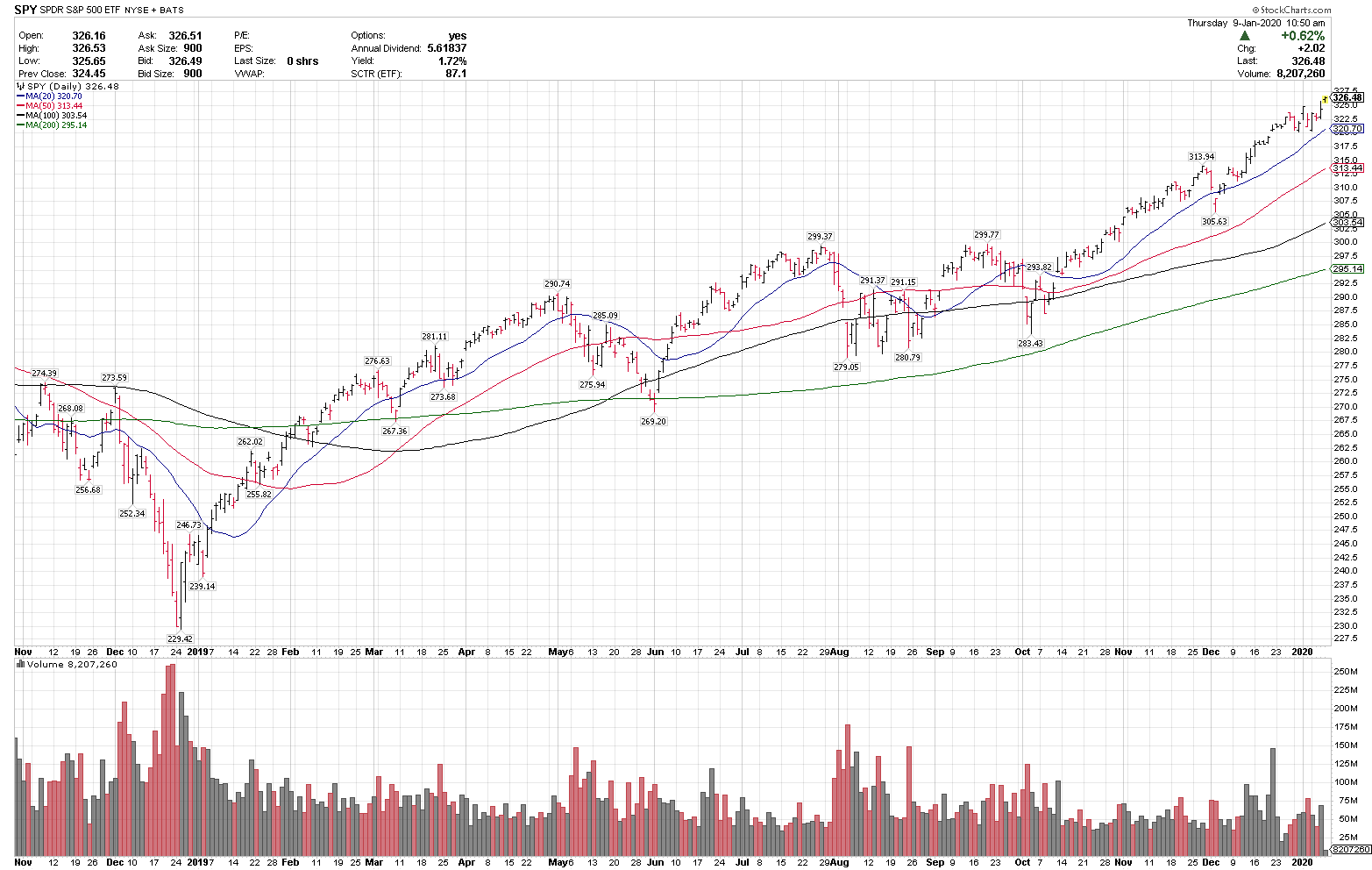

I originally penned the blog below “I Will Absolutely Be Long At The Top” in October of 2017, when the S&P ETF, SPY, was trading at a new all-time high of $254.37. Just over two years later, we are trading at another new all-time high, at $326.48.

The self-professed ‘smart money’ has been telling those of us who have been long all the way, the ‘actual smart money’, that we are doing it wrong because the economy is weak, or ‘it’s all based on buybacks’, or QE, or ‘not QE’ or that ‘valuations are too high’.

Meanwhile, in reality, we are experiencing a very powerful bull market, and life changing fortunes have been made in household names like Apple, $AAPL, Microsoft, $MSFT, and Google, $GOOGL, and the retirement plans of many casual investors who hold index funds, have reached record highs as well. With markets at new highs, and in the face of the consensus of many pundits who have predicting the end for years now, this is a stark reminder of two universal truths in markets:

1. We are either on the right side of the move, or the wrong side, and

2. We are either making money or making excuses.

With markets breaking out to new highs again, mega cap leaders leading the way and the Bears telling us that we are still doing it wrong, I thought this would be a good time to remind readers of why I follow the price, follow the trend and follow the process. Whenever “the Top” finally sets in, whether it is in 5 minutes, 5 weeks, or 5 years, I will still be riding the trend up and prepared to give some back on the way down, to be sure that I catch the full move.

BELOW IS THE ORIGINAL BLOG FROM 10/07/17

I Will Absolutely Be Long at the Top – Blue Chip Daily Trend Report

“I Will Absolutely Be Long At The Top”

Simply because I have been long all the way up. I launched my first post on Twitter on January 5, 2013. The S&P 500 Index ETF, SPY, closed that week at 133.08. Since then SPY is up 91%, and a countless number of mid to large cap names are up over triple digits. Even in the early days, I was called “Dumb Money”, a bagholder, and by one Twitter famous money manager, a “Noveaux Bull”. I was told that many of my posts were sure signs of a top. All of the bubble talk, and comments about “things ending badly” and this rally being unjustified because it was QE infused, or that valuations didn’t support it, were just as prevalent…91% ago. Many may read this blog and say that it is a sign of a “top”, maybe it is, maybe it isn’t, any outcome is always possible. Hopefully they have a decision making process more refined than trading contra to my blogs.

On Friday, January 4, 2013, SPY closed at 133.08 and the 200 day moving average was at 125.22, $7.86 or 5.90% below the closing price. SPY closed Friday, October 6, 2017 at 254.37, and the 200 day moving average sits at 237.34, $17.03 or 6.69% below.

So my exit points for my SPY position would be 5.9% (in 2013) or 6.6% today, beneath current prices. I view trading from a risk/reward perspective. I was prepared in January 2013 (and earlier, as I have been long equities for the most part dating back to mid 2009), to give back 5.9% on the downside, so that I could be positioned long to capture the upside, whatever the potential return may have been.

SPY JAN-4-2103, WHEN I JOINED TWITTER, $133.08

Today, I am absolutely prepared to give back that last 6.69% of profit, or 10%, whatever the number will be, to be long for the 91% +/- move on the way up…this is why I will absolutely be long at the very top.

By employing simple, but robust, price based Trend Following programs, I follow some very core concepts, which include:

Price reflects all known data.

The future is unknowable.

Noone can consistently predict future market moves.

Markets go where they go.

Trends can continue in both directions much further than most believe.

Any outcome is always possible.

People trade their beliefs and biases about markets.

Many are so caught up in trying to “be right” they get anchored into unprofitable opinions and positions.

The market doesn’t get it wrong, but traders and investors often do.

It seems that every day since day one, I have been seeing posts about bubbles, tops, crashes, 1929 overlays, year 2000 redux, margin debts stats, QE stats, various ancillary indicators, divergences, Hindenberg Omens, breadth stats, put/call ratios, insider activity stats, valuation metrics, etc., all to counter why the SPY chart was “wrong”, unjustified or about to roll over. These calls have obviously proven to be wrong on a very large scale, and quite costly for those expressing them, and their clients, in the case of Portfolio Managers.

SPY 10-26-2017, WHEN I WROTE THIS BLOG, $254.37

I learned long ago that trading to make money and trading to “be right” are not usually the same thing. The primary objective of traders/investors should be to turn a profit in search of absolute returns, regardless of market conditions. Getting on the same side of major market trends is a simple way to accomplish this. Fighting the market because it does not align with one’s preconceived notions is very costly, as the last eight years have proven.

Here is what I can state unequivocally: The price is the price and that is what determines your P/L on a daily basis. Every brokerage statement I have ever seen has a column labeled “Price”. I have never seen one with a column labeled “Opinions”. The price is reality, opinions and predictions are not.

Try to call Schwab or Fidelity and tell them to send you a check based on where you think the market should be, not where it is right now, and see how that works out. This is my attempt at humor of course, but you get my point. The price on the screen is it.

It seems people have a fear of being long at the “top” or caught in a bear market. I have pre-defined exit points for all positions. I know exactly what gets me in and what gets me out, I just don’t try to predict when it will happen or rationalize why. Trading with these pre-determined exit strategies allows me to continue to hold my long positions, risk-sized properly, with no hesitation or fear of being caught in a prolonged downtrend. My belief is that by knowing exactly what gets me out, from a technical price based perspective, I don’t feel the need to try to anticipate when the top is coming. I have fully accepted that I will be long at the top, that is the only way that I can ensure that I will catch the entire long term uptrends, which have been significantly profitable.

Think about this question for a minute: How many people have missed the triple digit move in SPY from 2009 and many, many multi-bagger moves in countless stocks across the board, because they have been wrapped up in their pre-conceived biases or were fearful of giving back that “last 5%” of profits? Maybe, because they lacked any type of objective price based exit strategy, not based on opinion or prediction? Essentially, missing out on 100%+ moves for the fear of giving back that “5%”. As Peter Lynch famously said “far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

$SPY TODAY, 1-09-2020, $326.48

So yes, whenever “the Top” finally occurs, rest assured I will be long and holding the bag and giving back that last 5-10% or whatever the number will be, but I won’t be holding it for long. When my price based exits are hit, I will be out without hesitation. You can also rest assured that I will be holding the bag all the way up on the 91%+ moves and multi-baggers along the way too. I will let others focus on trying to call the market and “be right”, I am going to continue to focus on trading profitably by following the plan.

Link to original blog https://trendtradingsignals.com/blog/i-will-absolutely-be-long-top-heres-why

LARRY TENTARELLI

PUBLISHER

https://bluechipdaily.com/