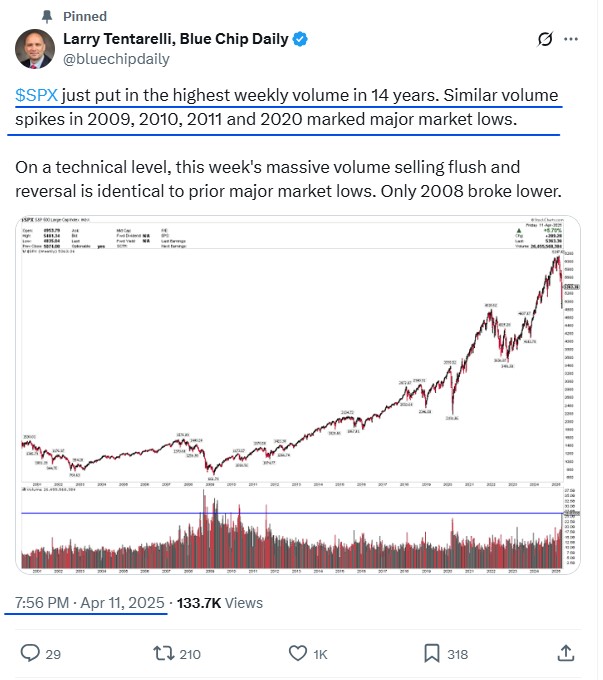

Our Chief Technical Strategist, Larry Tentarelli, told major media outlets including CNBC, Fox Business and Bloomberg, that the low was in for the S&P 500 at 4835.

Larry has shared ideas with some of the best minds in the investing industry. Below, at the New York Stock Exchange in June 2025 with Tom Lee, Co-Founder and Head of Research at Fundstrat and Global Head of Tech Research at Wedbush - the one and only Dan Ives.

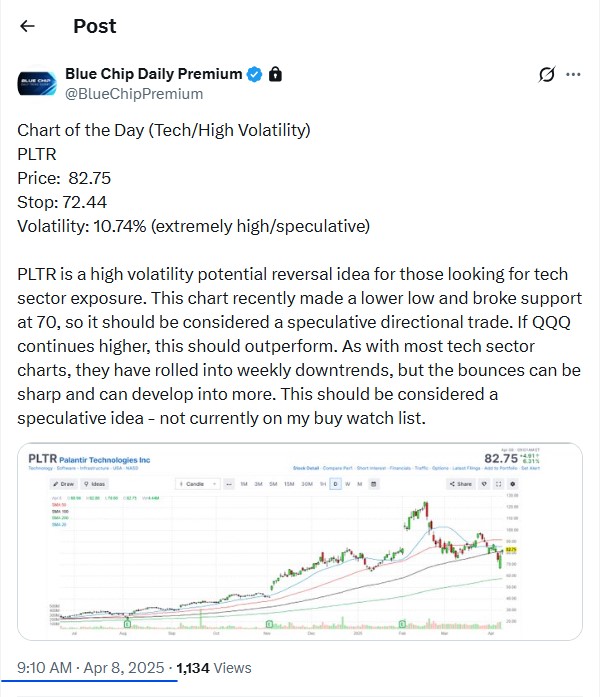

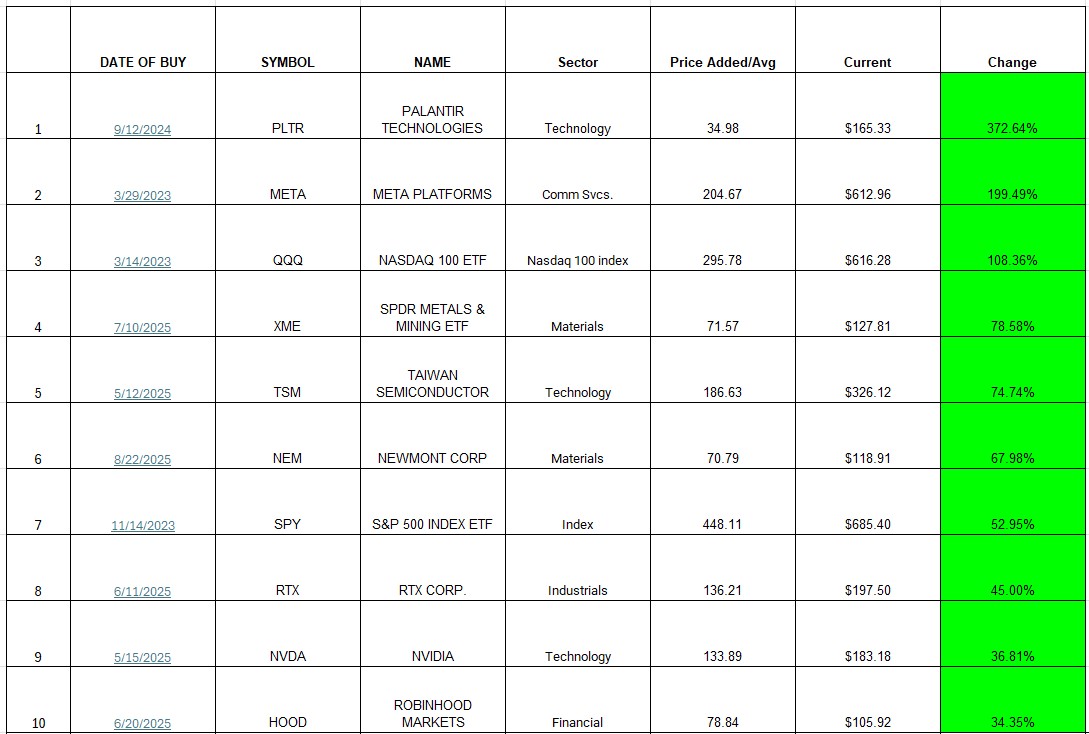

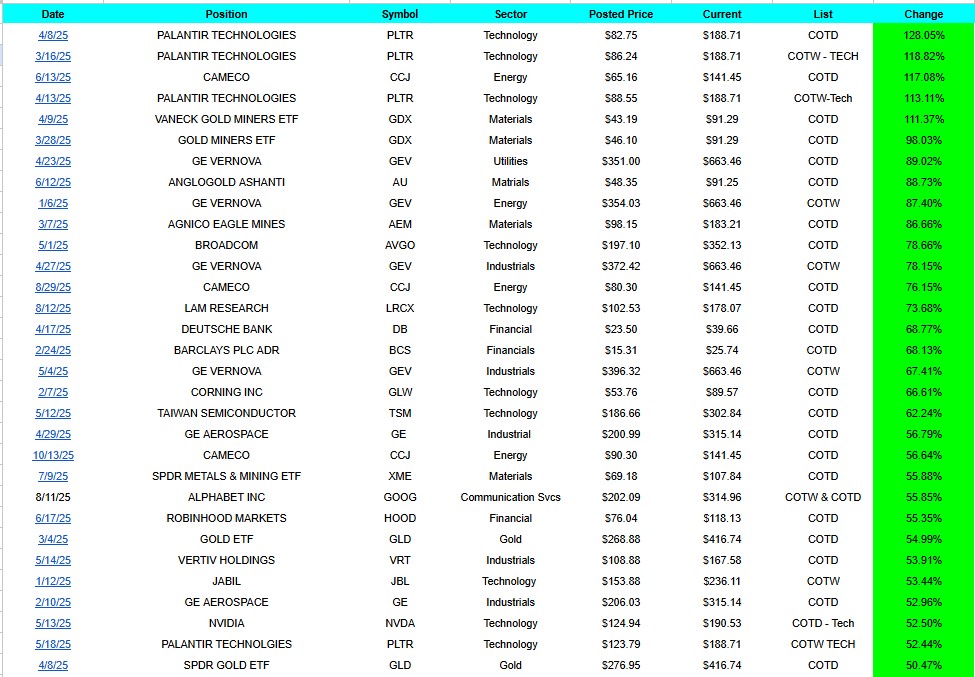

In 2025, we have 30 posted Chart of the Day or Chart of the Week ideas that are currently up from 50% to 128%. Data as of 12/28/25. Each Chart of the Day idea is tracked 24/7 on our members website, above.

In 2025, we have 30 posted Chart of the Day or Chart of the Week ideas that are currently up from 50% to 128%. Data as of 12/28/25. Each Chart of the Day idea is tracked 24/7 on our members website, above.