VIEW THE YOUTUBE VIDEO HERE: https://youtu.be/8cGiLxZY-Js

On November 30, 2021, Federal Reserve Chairman Jerome Powell, speaking to a Senate panel, said that the FOMC planned to accelerate their plans for tapering of monthly bond purchases. Powell also said “it’s probably a good time to retire” the word “transitory” to describe inflation.

Markets immediately pulled back, and from my experience in the equity markets, which started in 1998, I believed that the markets would enter a new cycle.

1. On December 5, 2021, 5 weeks ago, I published a Special Report & 19-minute Video for Blue Chip Daily Members titled “Our View on the Fed Pivot”.

- You can view a brief, public view of the Report here: Our View on the Fed Pivot – Blue Chip Daily Trend Report

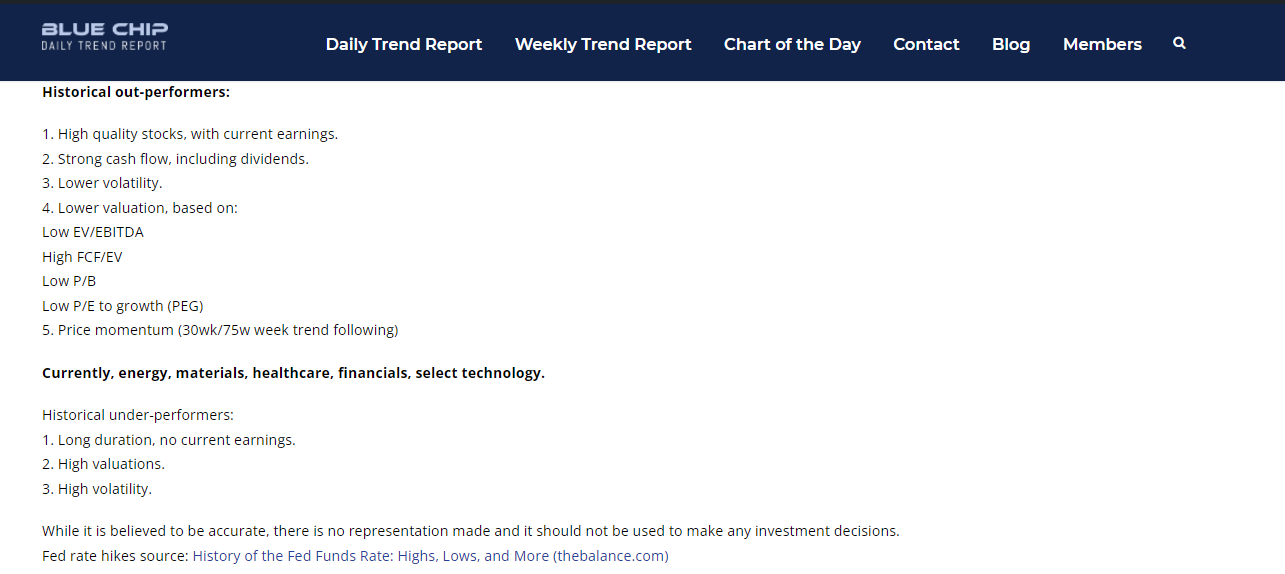

- In this report and video, I detailed for our Members the results of past Fed hiking cycles, going back to 1994, and I shared with them which sectors and styles I expected to outperform, and which I expected to underperform, based on extremely detailed research on my part of past data and charts, and also the current charts at that time.

Below is a brief screenshot from the detailed Members Report, dated 12/5/21:

- I went into great detail to outline that the focus going forward should be on high quality stocks with current earnings, lower valuations and lower volatility stocks.

- I also explained the stocks that have no earnings and high valuations should be expected to underperform and that I was avoiding them.

- Over the last 5 weeks, since my report, the markets have played out exactly as I outlined for Members.

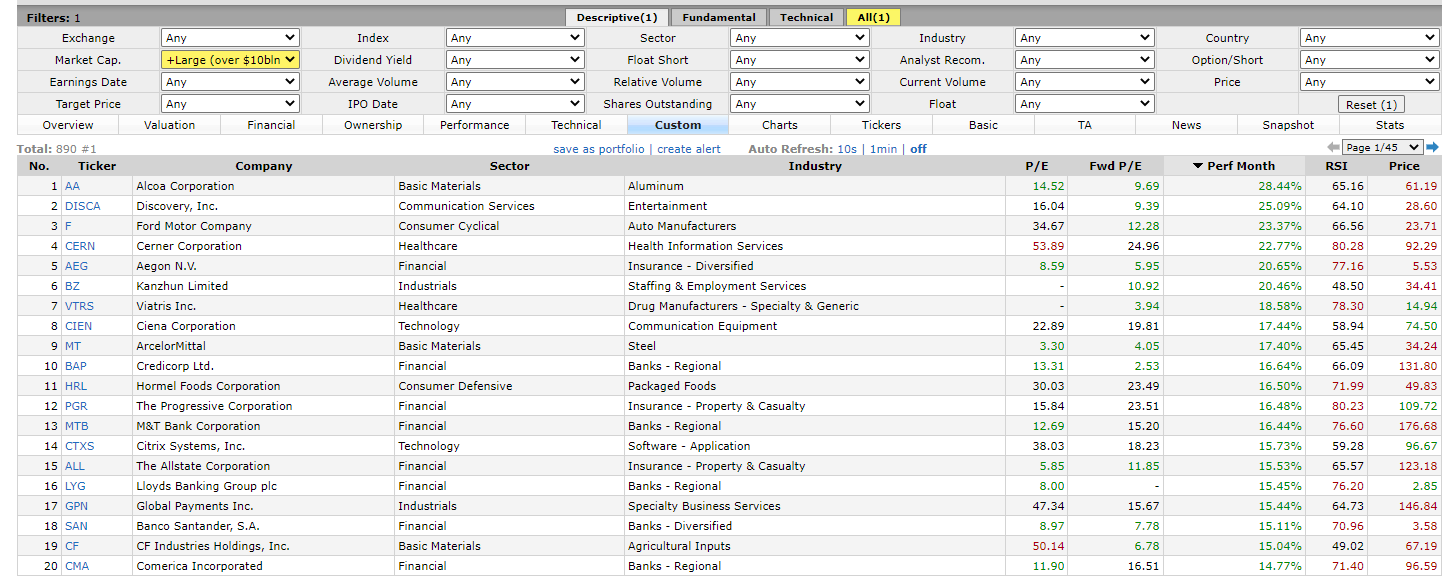

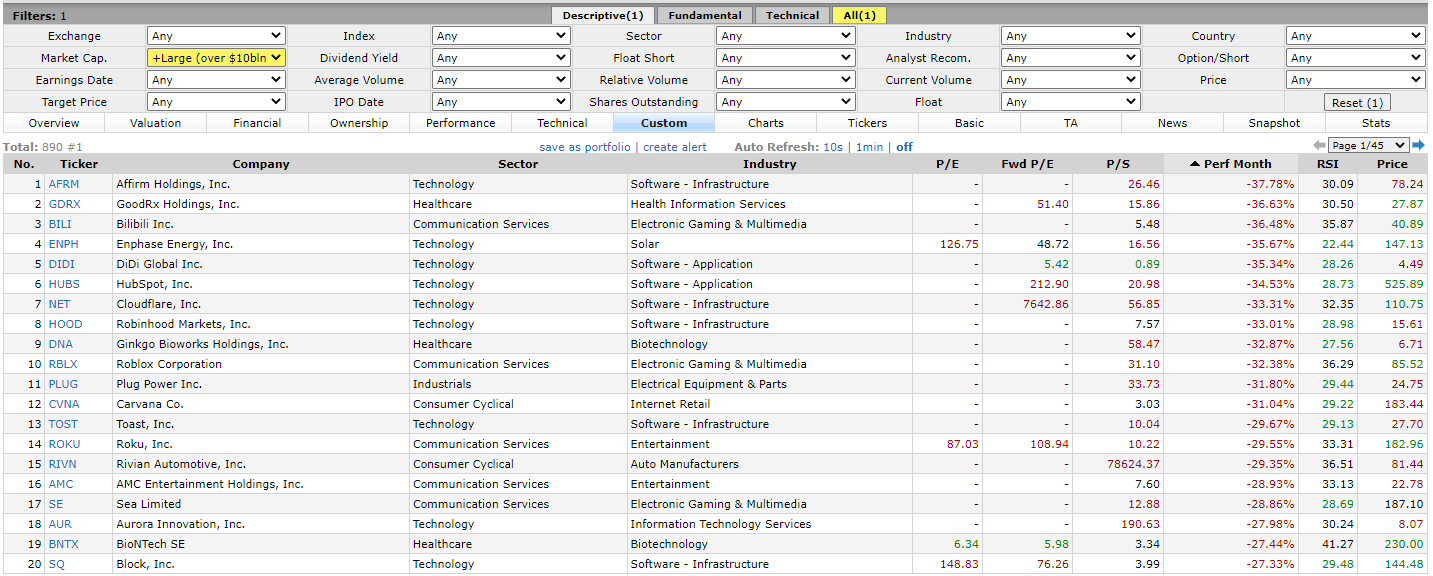

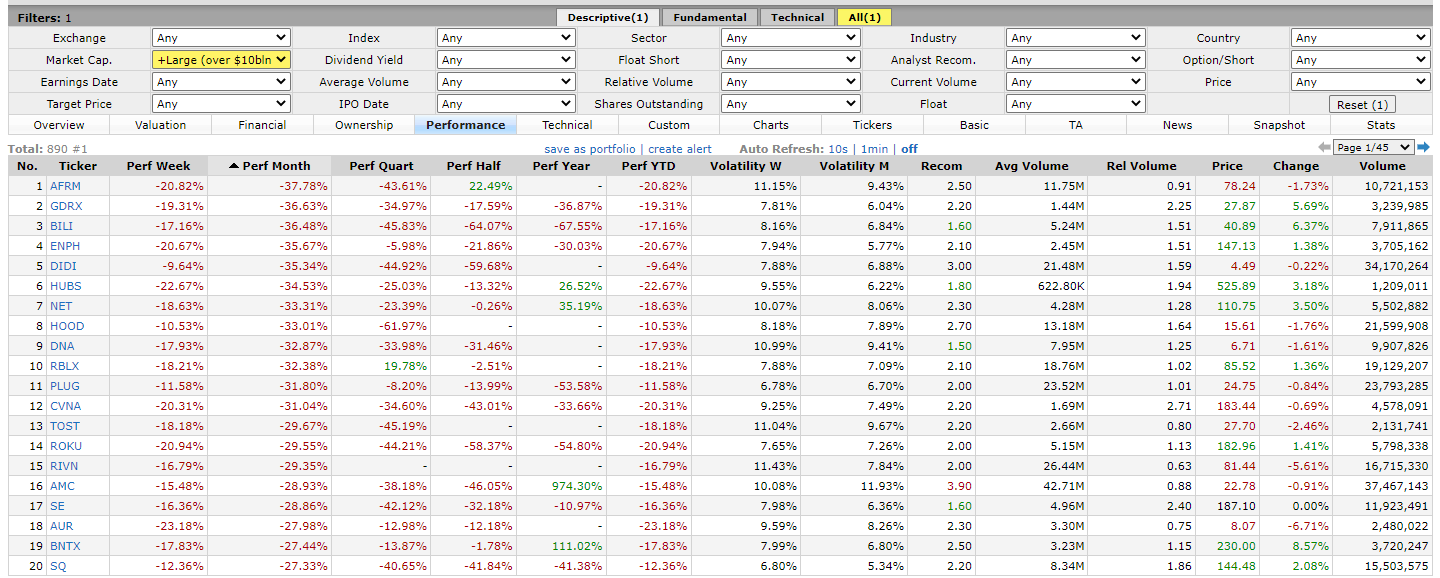

2. The last 6 weeks, going back to the Fed pivot on November 30, 2021, have shown a very sharp rotation into lower valuation stocks, mostly of profitable companies and sharply out of higher valuation stocks and many with no current earnings.

Of the top 20 large cap (over $10 billion market cap) performers over the last 30 days, all 20 of the companies are profitable. Their average forward P/E ratio is 12.52, the average trailing twelve months P/E is 22.01 and their average price to sales ratio is 3.65.

Of the bottom 20 performing large caps over the last 30 days, only 4-8 are profitable, based on if TTM or forward earnings is used. The price to sales ratio of these bottom 20 is 27.14. 27.14 vs 3.65 for the top 20.

This weakness in higher valuation/no EPS stocks has accelerated over the last week, with 19 of the bottom 20 down by double digits over the last week.

3. BLUE CHIP DAILY ROTATION OUT OF HIGH BETA GROWTH

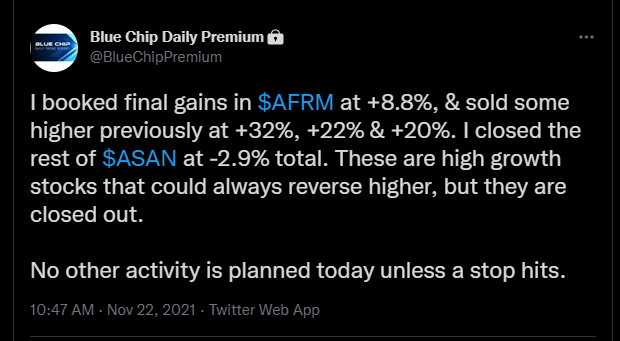

In November and December 2021, I booked gains or closed out the following positions below. I shared my activity in real-time with our Members:

Affirm Holdings (AFRM)

Sold at: 151.85 to 124.76

Recent pullback low: 71.70

Potential drawdown avoided: 52.8%

Airbnb (ABNB)

Sold at: 196.60 & 170.45

Recent pullback low: 149.44

Potential drawdown avoided: 23.9%

Asana (ASAN)

Sold at: 131.85 & 124.61

Recent pullbacks low: 56.55

Potential drawdown avoided: 57.11%

Roblox (RBLX)

Sold at: 96.11

Recent pullback low: 79.02

Potential drawdown avoided: 17.7%

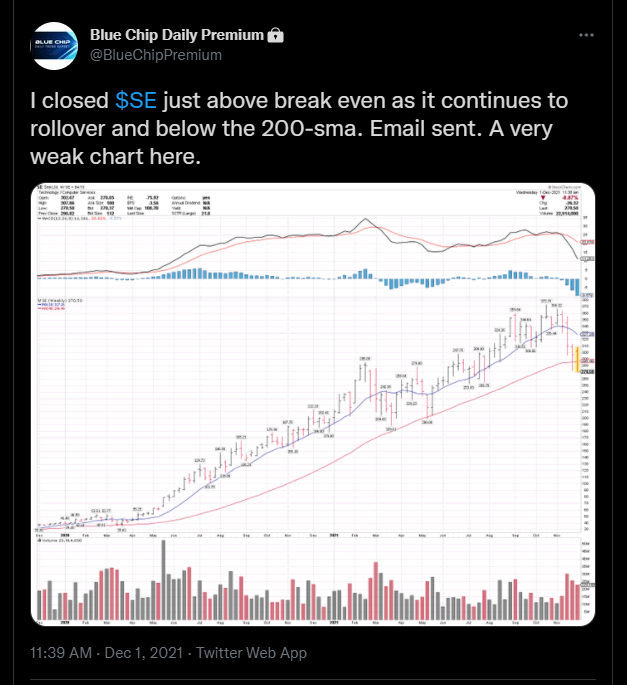

Sea Limited (SE)

Sold at: 271.30

Recent pullback low: 168.00

Potential drawdown avoided: 38.0%

Snowflake (SNOW)

Sold at: 392.32 & 341.24

Recent pullback low: 273.83

Potential drawdown avoided: 30.2%

Unity Software (U)

Sold at: 148.60

Recent pullback low: 114.12

Potential drawdown avoided: 23.2%

2021 closed positions can be viewed here: Posted Trade Alerts in 2021 – Blue Chip Daily Trend Report

4. BLUE CHIP DAILY ROTATION INTO HIGHER QUALITY, LOWER VALUATION STOCKS WITH EARNINGS:

Below are highlighted value/cyclical ideas that we shared with Members in our Chart of the Day and Chart of the Week format.

All of these stocks, along with others, appeared on Weekly Top 25 lists as well.

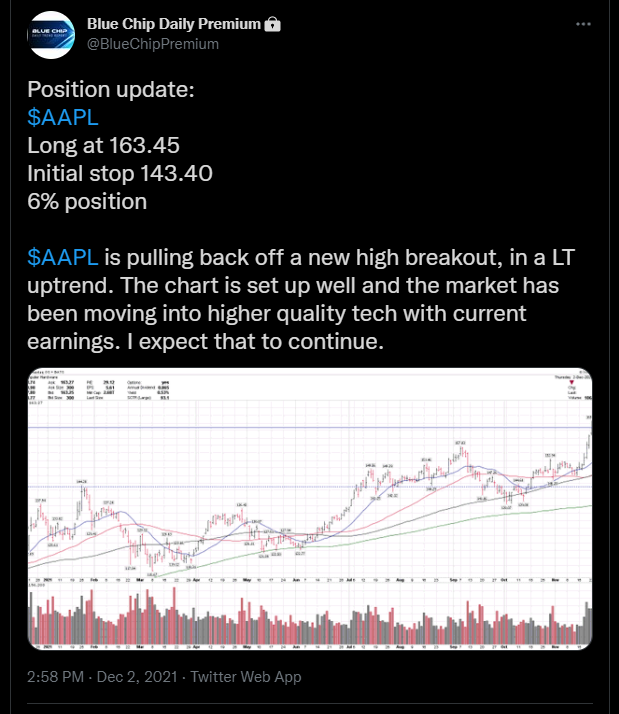

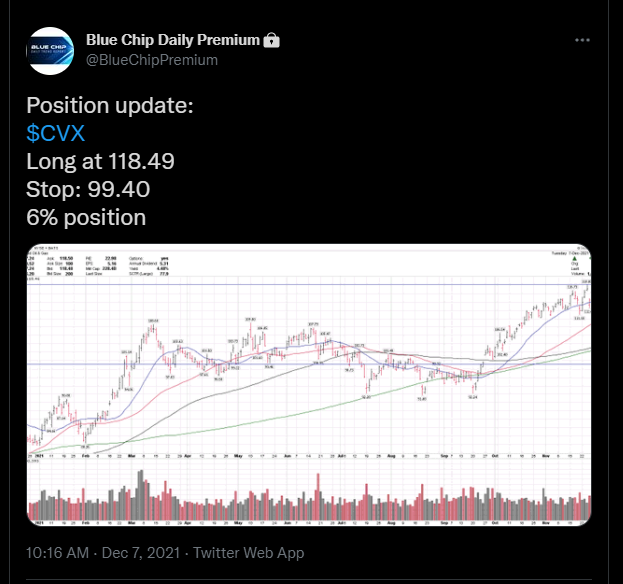

- I also added new long positions in Apple (AAPL), Charles Schawb Corp (SCHW), Chevron (CVX), Micron Technology (MU), and Pfizer (PFE), among others.

- All new buys listed above made new all-time highs after my buy.

- The high growth stocks that I sold declined significantly after my sale.

- I had other value exposure before that, including Bank of America (BAC) and Devon Energy (DVN), among others.

On 12/12/21, I expanded our Weekly High Dividend List to include other low volatility uptrends, to include more in consumer staples and real estate. Many of these ideas went on to new all-time highs including Diageo (DEO), Pepsi (PEP), and Procter & Gamble (PG).

I did this because I recognized that a number of lower volatility stocks were positioned to move higher, which they did.

5. RECAP:

11/30/21 FOMC hawkish pivot

12/5/21 Members only Special Report and Video

Expected to out-perform:

High quality stocks

Current earnings

Lower valuations

Lower volatility

Cyclicals (energy, banks, industrials, materials) and select tech and healthcare.

Avoid/expected to under-perform:

No current earnings

High valuations

High volatility

This preceded a historically sharp rotation out of high beta growth into lower valuation stocks and sectors.

- The Blue Chip Daily high growth stocks that we sold, declined sharply afterwards.

- The lower valuation stocks that we rotated into made new all-time highs.

- Blue Chip Daily Members were alerted in real-time and on a daily basis well over a month before the 2022 rotation accelerated.

JOIN BLUE CHIP DAILY TODAY: Blue Chip Daily Trend Report