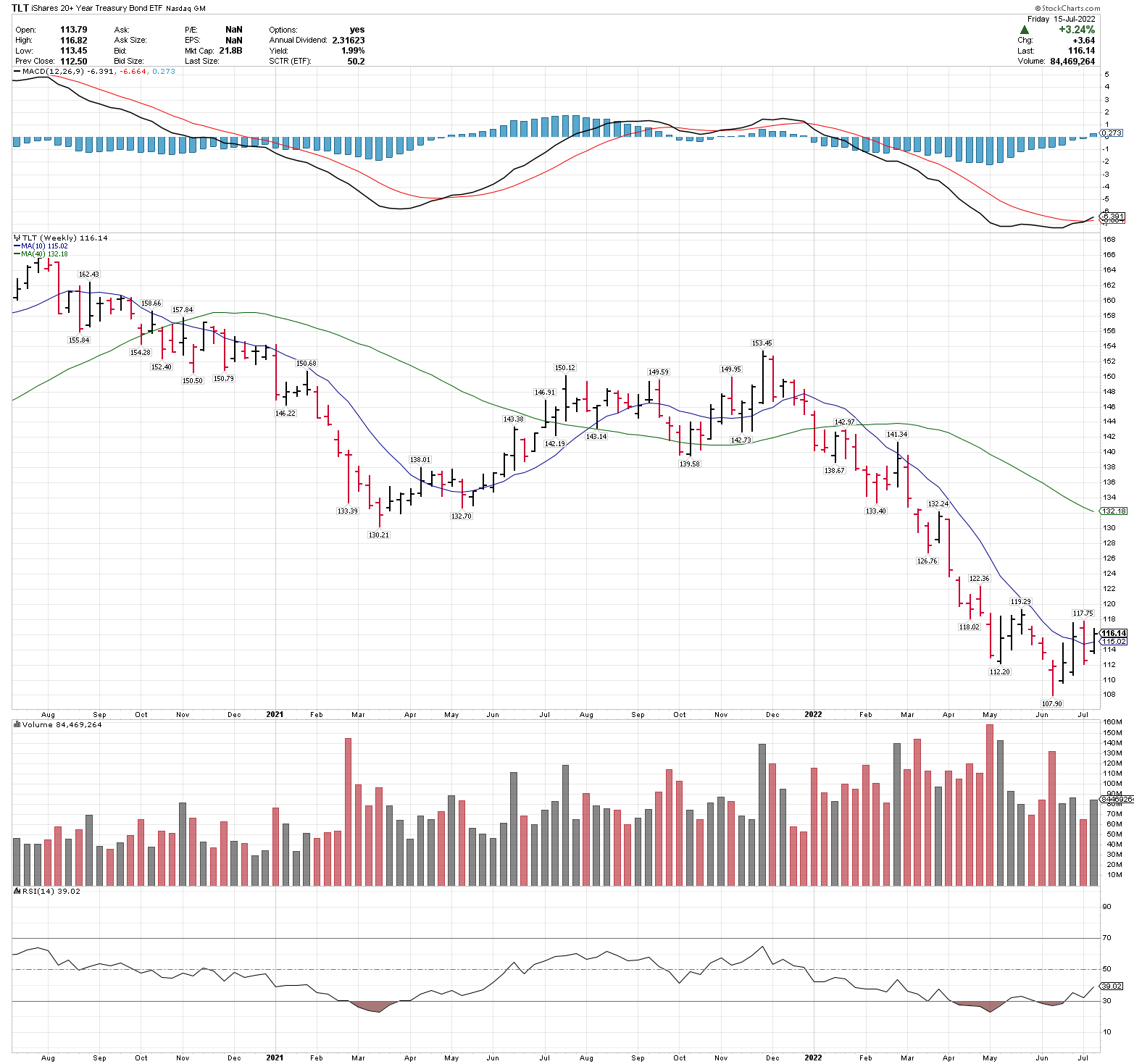

With the Federal Reserve on an aggressive path of hiking short-term interest rates, long-dated U.S. Treasury Bonds and iShares 20+ Year U.S Treasury Bond ETF (TLT) are showing signs of a potential long-term trend reversal beginning to develop.

The 2/10-year yield curve has inverted to the lowest level since December 2000. This suggests that the bond market is beginning to price in an economic slowdown, as aggressive Fed tightening starts to take effect. Historically, in a slowing economy, longer-term bond yields tend to drop, which should bode well for long-dated Treasurys and (TLT).

From a technical perspective, (TLT) recently reclaimed the 10-week (50-day) moving average, with two of three weekly closes above the 10-week dma over the last three weeks. (TLT) had been below the 10-week dma since December 2022. From a weekly trend perspective, (TLT) just completed a bullish weekly MACD cross, which indicates improving trend momentum. I continue to expect above average volatility in the bond market, so it is important for (TLT) to stay above 108-110 on any pullbacks.

Longer-term trend reversals can take some time to develop, as markets move from downtrend to uptrend, but the upside potential from here is favorable.