I turned very defensive on February 23, 4 days off the recent highs and began to get very constructive, on April 6, at the current, at least near-term lows.

As early as February 23, almost 8 weeks ago from today, I have been cautioning readers of my X/Twitter page to stay defensive and to not buy stocks on the way down. I have been sharing the same message with Blue Chip Daily subscribers on a daily basis over the same time period. This was before the S&P 500 went on to drop by over 21% in that 8-week period.

I shared this same cautionary message in TV interviews with:

Fox Business Network

Schwab Network

Yahoo Finance

and the NYSE.

I also shared this cautionary message in print with:

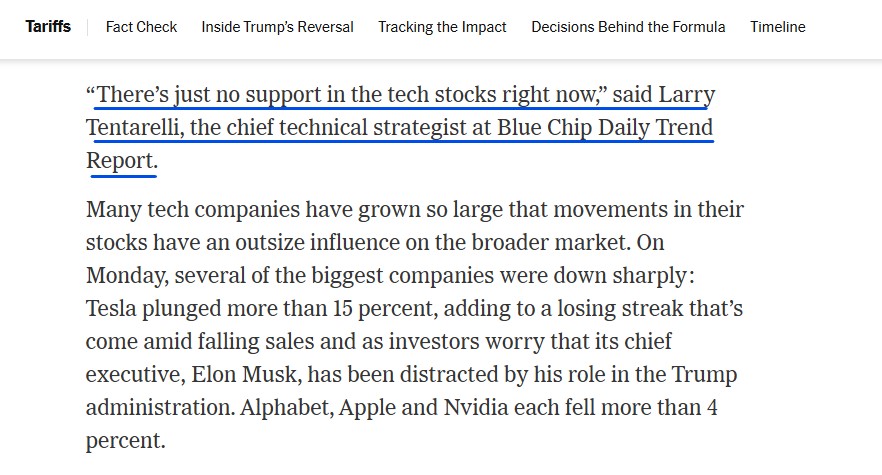

CNBC

Bloomberg

and the New York Times, among others.

(My NYT commentary from 3/10/25)

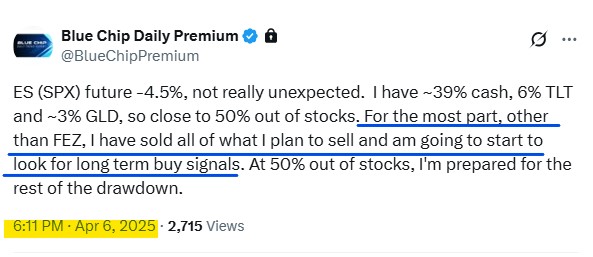

Following 8 weeks of being cautious, my messaging changed on Sunday April 6, near the lows of the Sunday overnight futures session.

APRIL 6, 6:22 PM

(On my public X/Twitter page)

At the Sunday night lows, which may turn out to be the low of this pullback cycle.

APRIL 6, 6:11 PM

(On our subscribers only X/Twitter page)

…”For the most part, other than FEZ, I have sold all of what I plan to sell and am going to start to look for long term buy signals”.

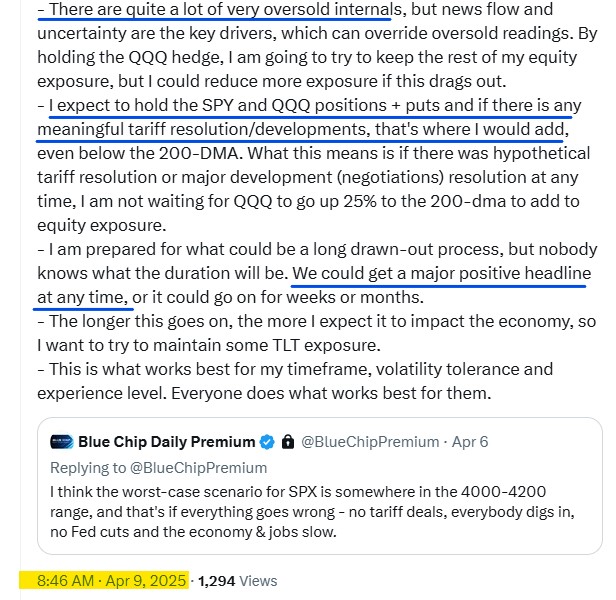

APRIL 9, PRE-MARKET, 8:46 AM

(On our subscribers only X/Twitter page)

I shared exactly what my plans were to buy if we were to get some type of major change in the tariff news cycle.

…”we could get a major positive headline at any time”…

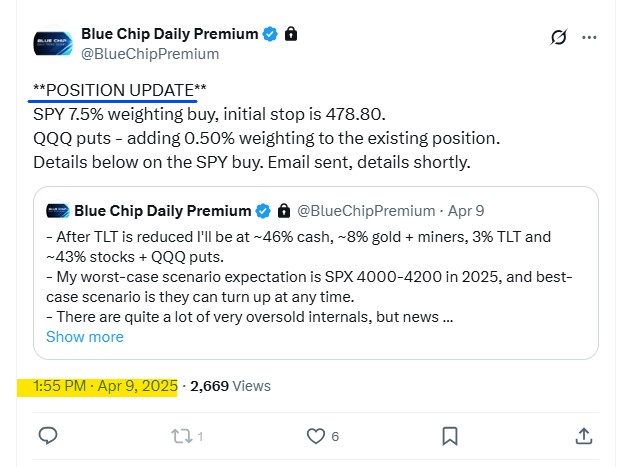

APRIL 9, 1:55 PM

On our subscribers only, X/Twitter page.

The 90-day tariff pause was announced, I made two full size position buys. (One alert is below, there were two buys that day. Members are alerted to all account activity in real-time).