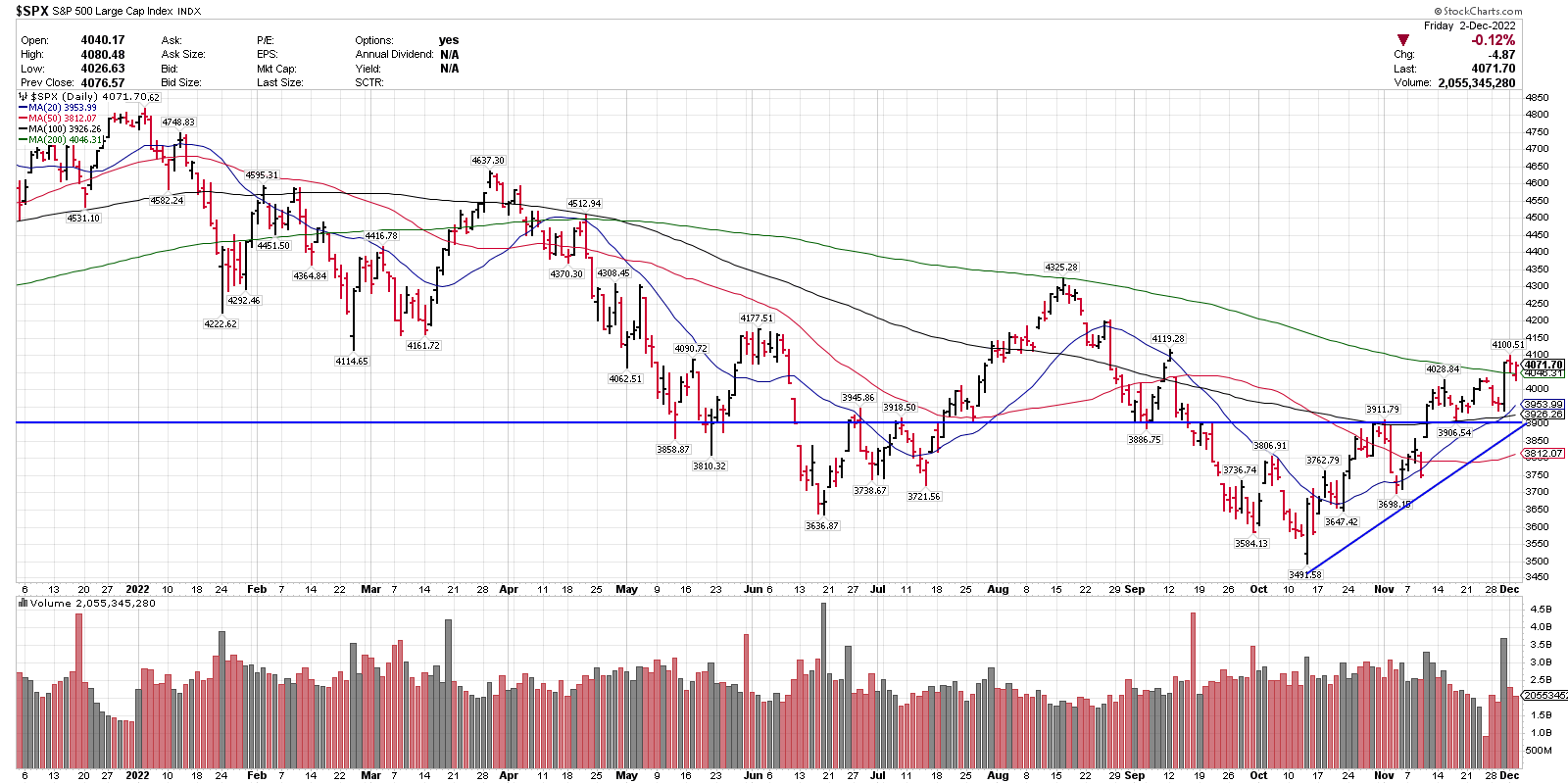

Today’s Monthly technical update is a follow up to our last Monthly update, sent on 11/5/22.

- In our 11/5/22 technical update, we confirmed that the recent S&P 500 index (SPX) rally attempt was intact, as long as (SPX) held over 3650.

- (SPX) closed on 11/4/22 at 3770.55.

- (SPX) closed this past Friday, 12/2/22 at 4071.70, or +7.9% from our 11/5 technical update.

Our view here remains that the (SPX) rally is still intact currently, as long as it holds over 3900 on a closing basis. Commentary below.

Our technical base case:

- (SPX) is making a series of higher highs and higher lows since the 10/13 lows.

- The 20, 50 and 100-sma have all turned up, and (SPX) closed over the 200-sma for the first time since April 2022.

- Wednesday’s volume is the highest upside volume day since the mid-June tactical low.

- 10-year UST bond yields (TNX) and US Dollar Index (USD) have both rolled over recently, which has been a benefit to (SPX) as well.

- Our year-end target range has moved up to 4100-4300, from the 3800-3900 target set on 10/17/22.

- There are 4 key risks to this year-end target range, which I have shared with members over the last 4 weeks. These are available on the members website.

- We also recently started new positions in US Treasury Bond ETF (TLT) and the precious metals sector.

- In our technical view, both groups could be set to out-perform in 2023.

- Start a 30-day trial to Blue Chip Daily today, to get our best technical insights daily.

- Free trial link: 30 Day Free Trial – Blue Chip Daily Trend Report