Starting on February 25, following our technical trading plan, we shifted to a fully defensive mode and stated to raise cash when the S&P 500, $SPX, broke below 3200.

We started to exit positions via preplanned stops and stopped buying any single stocks. Our last single stock buy was February 21, and our first single stock buy after that was just recently on March 26.

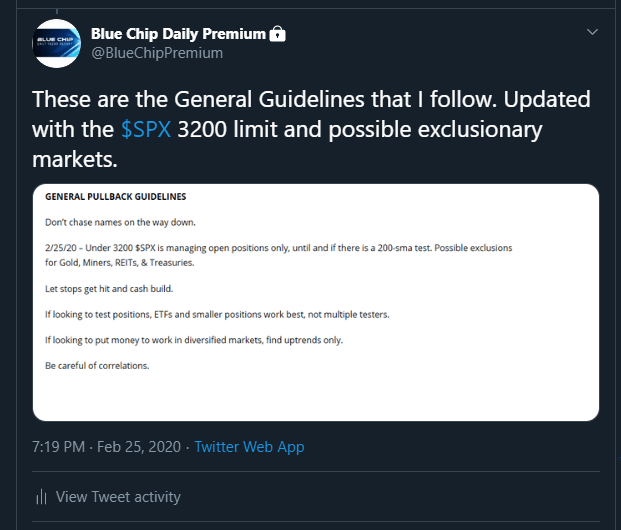

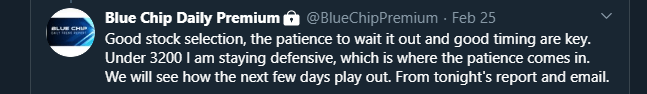

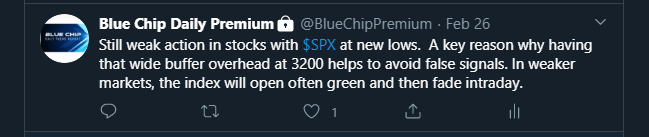

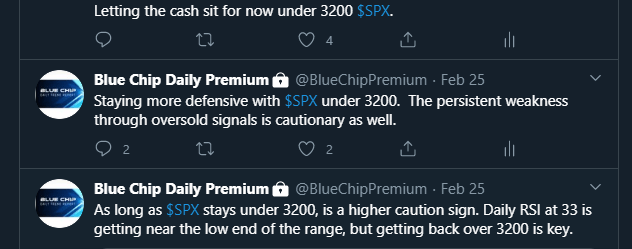

Following are screenshots from our Members only premium Twitter feed as we explained our new stance.

Posted on 2/25, our General Guidelines for under $SPX 3200, which reads:

“Don’t chase names on the way down”

“2/25/20 – Under 3200 $SPX is managing open positions only, until and if there is a 200-sma test. Possible exclusions for Gold, Miners, REITs, & Treasuries.”

“Let stops get hit and cash build.”

“If looking to test positions, ETFs and smaller positions work best, not multiple testers.”

“If looking to put money to work in diversified markets, find uptrends only.”

“BE careful of correlations”.