Last week, the Bloomberg Commodities Index had a record week, the best week in it’s 62-year history.

Blue Chip Daily Members were positioned well ahead of the move.

3. Four of our 10 total open positions currently are commodity-based positions. The posted buy alerts were shared with Members in real-time, and the four positions all made new highs last week:

Devon Energy (DVN)

Chevron (CVX)

Vale SA (VALE)

Invesco Commodity Index ETF (DBC)

4. Devon Energy (DVN) Buy

9/14/21

+108.87%

Partial gains booked, still holding.

5. Chevron (CVX) Buy

12/7/21

+33.89%

Partial gains booked, still holding.

6. Vale SA (VALE) Buy

2/4/22

+22.79%

Partial gains booked, still holding.

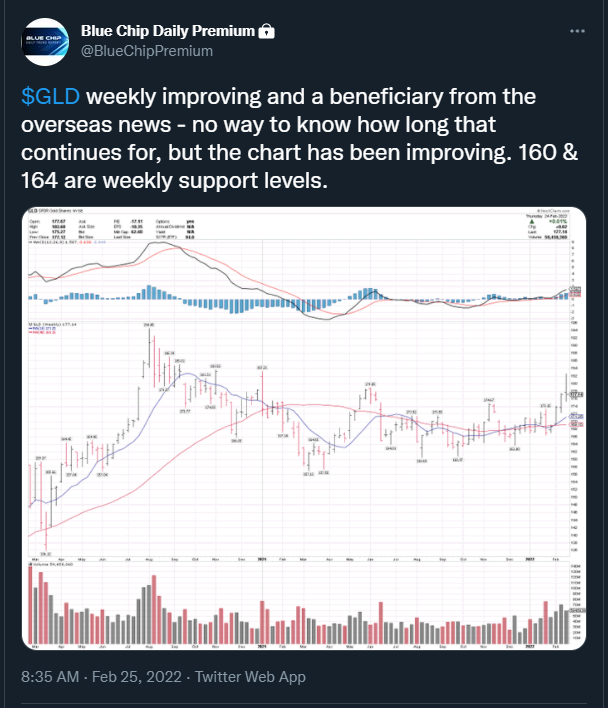

7. Commodity Index ETF (DBC) Buy

2/17/22

+17.49%

8. Every Sunday morning, we publish a weekly top 25 list for Members, with our best large cap ideas across all 11 S&P sectors.

From last week’s top 25 list, published on 2/27/22, there were 14 of 25 stocks that broke out to new highs for the week.

(Alcoa, Abbvie, Amerisource Bergen, Archer Daniels Midland, Bristol Myers, Devon Energy, Lockheed Martin, McKesson, Altria, Nutrien, Palo Alto Networks, Raytheon, Teck Resources, Exxon Mobil)

9. Our Chart of the Week, posted last Sunday was Energy ETF (XLE). XLE was +9.22% on the week.

10. Our Chart of the Day on Friday, 2/25/22 (9 days ago) was Nutrien, NTR. It is +22.6% since it was posted.

11. Our Chart of the Day on 2/9/22, Freeport McMoran (FCX) is +23.33% since it was posted.

Other technical alerts in commodities and natural resources positions in the week before the commodities breakout:

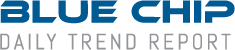

2/27/22

Posted before the record week in commodities.

2/27/22 Post

AA +16.45% week after posted

BHP +9.04%

NTR +16.45%

TECK +12.62%

2/25/22

(VALE) + 18.0% after this post.

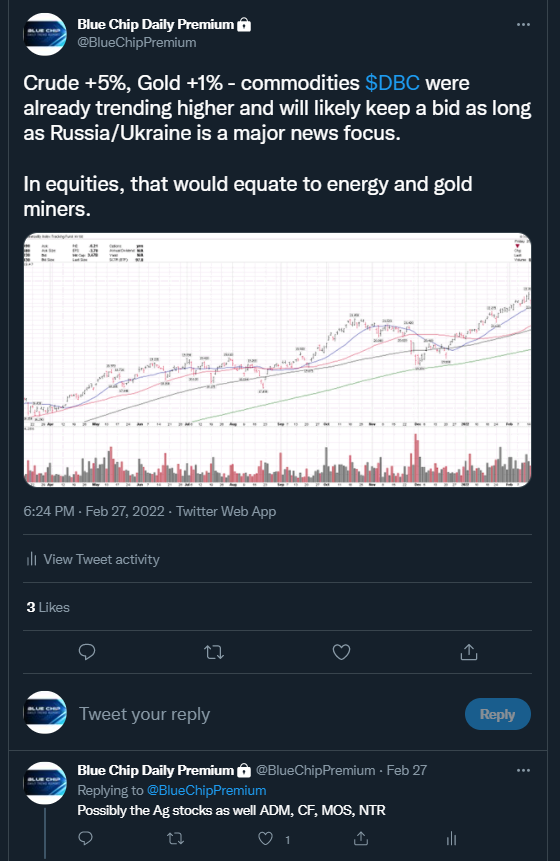

2/25/22

(TECK) +16.8% after this post.

2/25/22

(DBC) +13.3% after this post.

2/25/22

(GLD) +3.6% after this post.

2/24/22

(MOS) +32.7% since.

(NTR) +22.8% since.

2/24/22

(DBC)

2/24/22

(GLD)

JOIN US NOW TO GET OUR BEST TECHNICAL INSIGHTS DAILY: Blue Chip Daily Trend Report