5/31/21

Blue Chip Daily Chart of the Week:

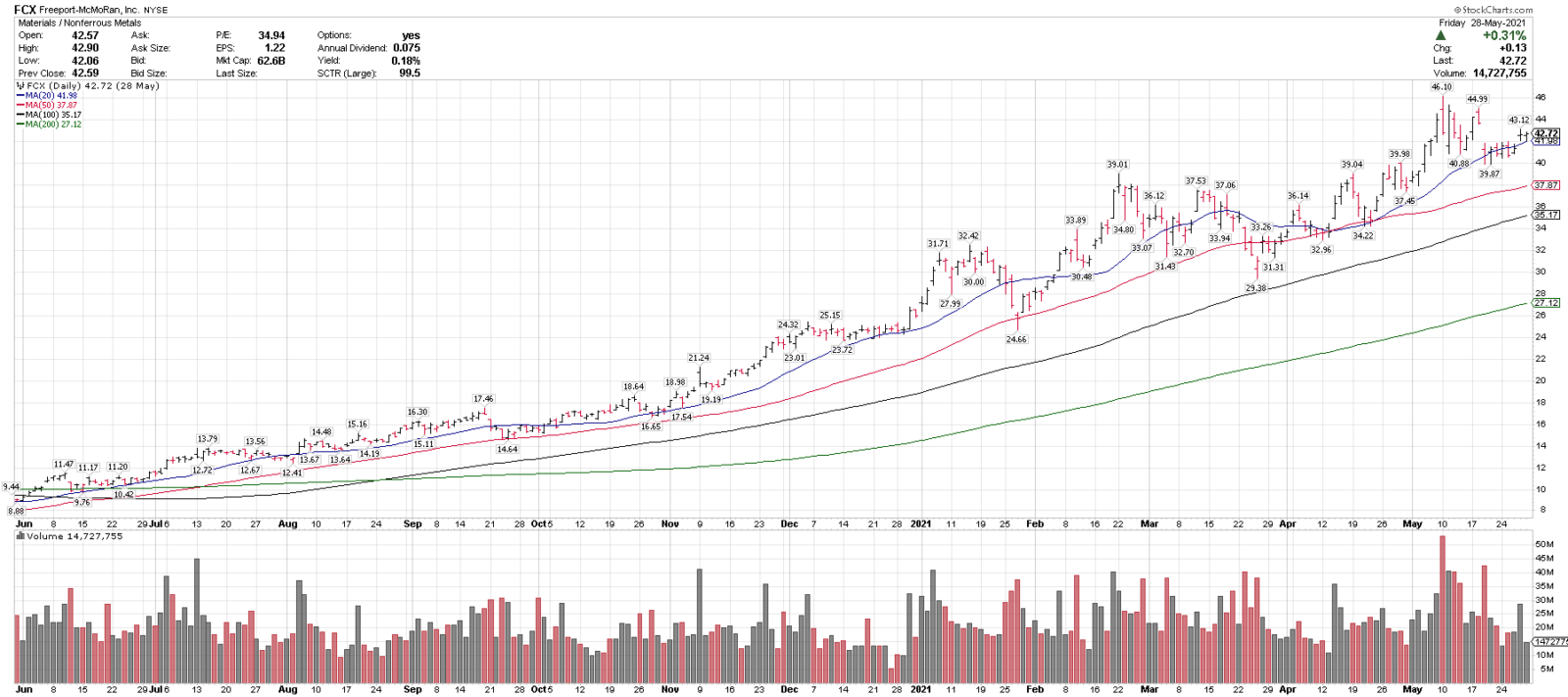

Freeport McMoran, FCX

Close: 42.72

Stop level for position traders and investors: 34.90 (a wider stop below the 100-sma for now, which can trail higher)

please see chart analysis below

- Freeport McMoran, (FCX) is one of our top technical ideas coming into the week, and is on this week’s Members Top 25 Stocks List.

- FCX is currently trading over rising 20, 50, 100 & 200-day moving averages, indicating an uptrend on multiple time frames.

- FCX recently pulled back 13.5% from 10-year highs, and held above the 50-sma.

- FCX is a higher than average volatility stock, but has remained in a steady uptrend over the 100-sma since June 2020.

- 36-40 is a key support level and over 46 could signal a breakout higher.

- Copper also broke out to a new all-time monthly closing high on Friday, which could bode well for FCX.

- FCX has been on our Chart of the Day list and Top 25 list repeatedly since first posted on 6/3/20 and it is currently +332% since then.

- Disclosure: I am currently long FCX.

Have a great week,

Larry Tentarelli

Publisher

Disclaimer – Blue Chip Daily Trend Report