In sports it is said that Defense wins championships. Trading is no different. In my two decade study of some of the greatest traders and investors ever, George Soros, Stan Druckenmiller, Paul Tudor Jones, Bruce Kovner, Warren Buffett and others, they share different methods, but they all discuss risk management and loss control in great detail. I recently did a blog about Paul Tudor Jones from his Market Wizards interview and most of it is about risk management and money management.

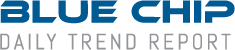

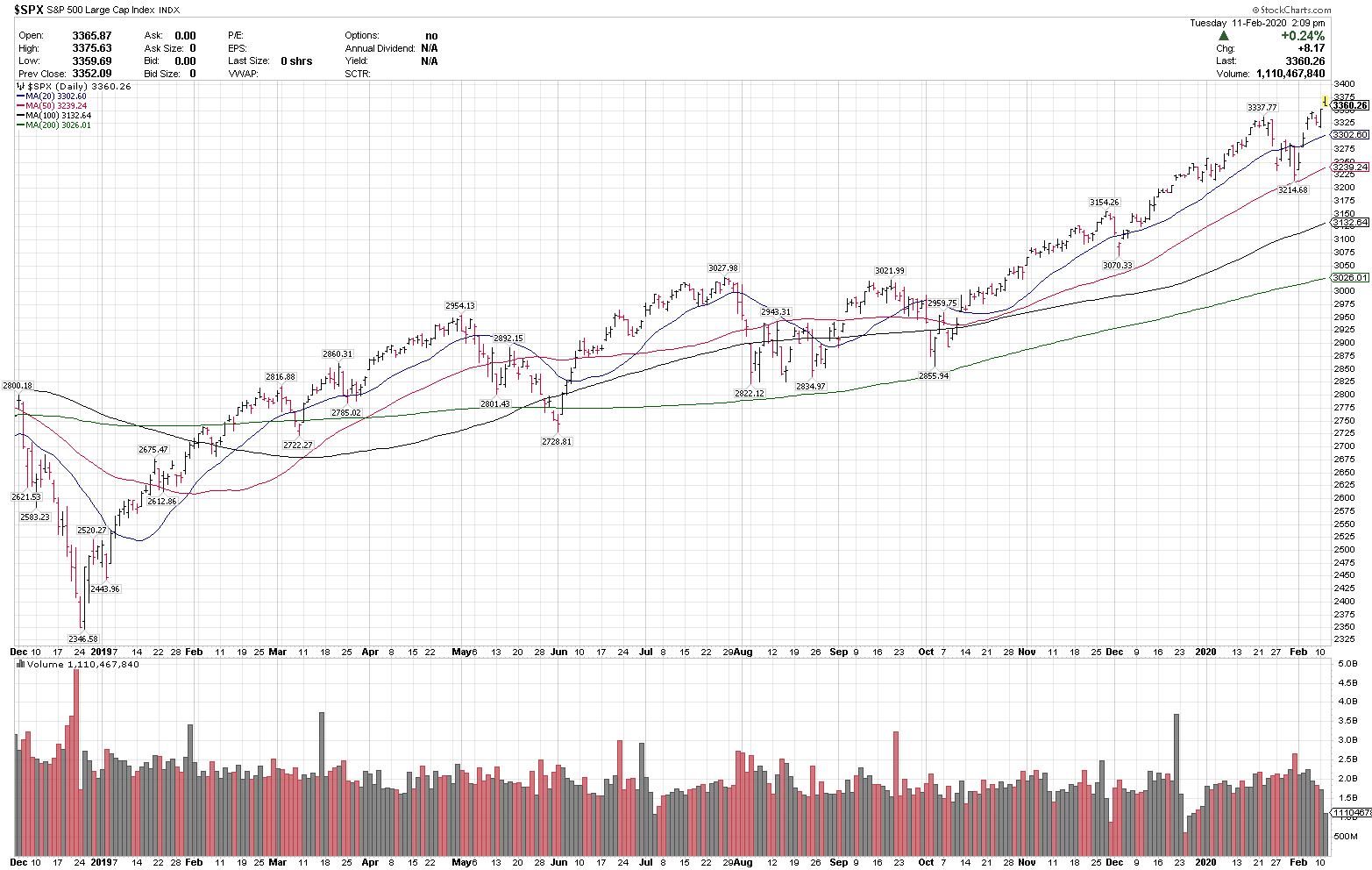

Great defense and risk management has to be at the core of any trading plan. It is my belief that if we can position ourselves to not lose alot of money in single positions and in the accounts overall during drawdowns, it is easier to be profitable. Think of your account equity as a stock. A high relative strength stock holds up much better than average in drawdowns. In the recent late January pullback, the S&P 500 went down to test it’s 50 day moving average. High relative strength sectors like Technology, $XLK, barely broke the 20day moving average, and has outperformed the broad market. Account equity works the exact same way, usually more narrow equity drawdowns make it easier to recoup prior equity.

Below I will discuss five key ideas:

As with any successful business, all traders should have a written operating plan, a trading plan, to dictate core components of the trading process. A core component of the trading plan has to be account structure. Key items to address: What is the total account value? For the sake of illustration, I will base the math off of $100,000, but obviously each person trades at different levels.

How much risk vs starting capital do you want to take on? A general strategy here is 10%. If you start your trading account with $100,000, then you may designate that you are willing to risk $10,000 vs your original capital. Meaning if for any reason the original $100,000 capital base draws down by 10% to $90,000, then no further trading activity is allowed until the account stabilizes and in some cases positions may be reduced or eliminated until equity turns back up.

1. Risk sizing

Once the drawdown limit is set, (in this example $10,000) then the position structure is determined. One common method is to risk 1% of capital in ETFs and .50% in stocks. This means if an ETF position gets stopped out, it will result in a 1% loss of capital ($1,000) and if a single stock position gets stopped out it will cost $500. Single stock position risk is often lower due to the event risk and gap risk that can occur by holding single stocks. This is also based on risk tolerance. Some use a fixed .50% or 1% across all asset classes. I keep single stocks at .50% to account for event risk and gap risk. This is an individual choice.

Using the above math, a trader could hold 10 ETFs at 1% risk each, or 20 single stocks at .50% risk each, or 5 ETFs at 1% risk and 10 stocks at .50% risk. Basically any combination that adds up to 10% risk. If your risk is at 5%, you may want to consider smaller sizing, or less positions. It is important to have enough in positions to make an impact if they work, however. A trader can set their personal risk threshold higher or lower. The 10% rule is just an example. It is universally accepted that most traders can not handle as big of a drawdown as they think they can. Drawdowns in reality are much more difficult mentally they are just thinking about them. When in doubt, I risk less, more risk can be added at any time. Here is a key concept to address, and it is something I first heard discussed by Paul Tudor Jones. Traders need to presume every day that every single one of their positions will go against them and get stopped out. This is how I adjust my risk settings. I under-trade my exposure.

The idea here is if one pre-determines a risk threshold that they are comfortable with, they structure their trades to a level that they are comfortable with, don’t get overexposed, and should be able to sit through drawdowns and stops being hit. There is no guarantee, stocks do gap down and markets gap down. There is always risk in all investing and trading. Losing trades and a string of losing trades are a constant in trading and investing. Taking small risk adjusted losers is essential to preventing large losers from happening. The idea is to not take on too much risk and then get shaken out in a pullback and lock in losses that may not have hit pre-determined stop levels.

Being able to sit in the face of drawdowns and not cut longer term positions early is key. Positions do need room to work. To further reduce exposure, once a trade shows a profit, some choose to move the stop up to reduce risk, often times to breakeven. This is a viable strategy which helps reduce drawdowns. Raising exit stops can be done in certain occurrences, but will often cut trades short. I use index ETFs and sector ETFs to add or reduce exposure and for some intermediate term trades, which I will discuss in the scaling section.

The overall concept is that if you pre-determine how much risk and drawdown you are prepared to withstand if every position gets stopped pout, this should help detach from the emotional aspect of equity swings.

2. Use Hard Stop Losses In The Market

A subject of great debate, some fear a stop run and that market makers will take their positions. Part of this concern was popularized by Paul Tudor Jones in the Market Wizards book, when he described being one of the largest traders in the S&P Futures market, a valid concern by him at that time. In today’s age of electronic trading, this is not so commonplace. I trade in very liquid large cap and mega cap stocks which have tighter spreads and ETFs. I also use volatility based stops outside of a day’s range of trading which helps. If my stop in JP Morgan is 10% below the current market, it isn’t likely that a stop run will find my stop, although it could. Algos and buy orders will usually step in and catch it. I use hard stops at entry always and some convert to closing price stops not in the market after 30 days.

The bigger issue here is a stop is in place to keep risk in check. If the price triggers that level, then the trade needs to exited. “Mental stops” make it too easy to wait and hope for a better price. Some pros use hard stops, some do not. There are valid debates on both sides. In the recent sell off on February 5, many stops were hit and then the stocks reversed higher, which frustrates many. However, there is no guarantee that those positions would turn around, and had they kept moving lower, account equity would have taken a much bigger loss.

3. Scaling

Scaling is a great risk management tool to take partial profits and/or reduce exposure as market conditions dictate. Often trades will run ahead and produce nice gains, and some traders feel the pressure to cash in their winner, possibly too early. By scaling, or taking a partial profit, it allows the trader to book some gains, reduce open exposure and take the pressure off of themselves to exit the entire trade.

Some argue that scaling is “not Trend Following” or question what about “riding winners”? Most successful traders and funds that I know of use a few different strategies to increase their risk adjusted returns. A trader has to operate under a money management process that they can execute consistently. Many struggle with large account equity swings and watching winning trades become losing trades in the process. There is no right or wrong answer. Over time, I have used scaling more often in times of higher volatility, with trailing stops, or when positions breach key momentum levels.

When I learned how to scale, my holding period for winning trades went up considerably as did my overall results. The easiest way that I know of to scale, for any positions that I rarely choose to do so in, is to use a stop below a shorter term moving average, usually the 10 day sma, to dictate the partial exit.

4. Hedging

My clear belief is that the absolute best hedge is reduced exposure, higher cash levels and reduced trading frequency. Over two decades I have tried it all. Options, straddles, short strategies, inverse ETFs, long/short, market neutral, etc. My experience, and that of most professionals I have discussed this with, is that hedging via more positions (shorts) etc., usually results in more complication, a drag on performance, and often more losses if the hedge is not timed correctly.

I am not saying that it can not be done correctly or that it doesn’t work. I am saying that my experience is that it adds more complication and is best done by experienced professionals. Instead of being 100% long and trying to hedge 30% , I’d rather be 70% long and have 30% in cash. Scaling is a simple way to raise cash. If someone is 100 invested and the scale off 20% across the top, they still have their positions, but less at risk.

With that being said, my preferred hedge, after higher cash balances, would be a straight index put option on either the S&P 500 (SPY) or Nasdaq 100 (QQQ). I rarely use options, because my research over the years has shown that most option expire worthless. Those who trade options actively may look to sell options, to capture the premiums, but there are other complications to being a seller of options contracts that is beyond my focus.

I look for the major open interest contracts, generally out 3-6 weeks and within 5-10% of the current index price.

I size the put options assuming that the contracts could expire worthless and that the price I paid would be considered “insurance”.

5. Use Index ETFs For Directional Trades To Add/Reduce Exposure

One of the best strategies that I have used over time to increase incremental gains is to use index ETFs, usually QQQ or a sector ETF, to buy into a market on a pullback, using the ETF to eliminate single stock risk, and let the trade play out for a few weeks. When the trade runs its course, I will use a moving average to scale or book the gain in the entire position. The trades have a higher win rate, and sometimes they turn into big gains, sometimes smaller wins, but it allows me to take incremental gains along the way and dial back exposure when necessary. An example is in late December 2018 and early October 2019, I took max long positions in SPY or QQQ.

At any point I can raise my stop on the ETF position, and they are often less volatile than single stock names, and exit that position to reduce exposure.

The key to understand is that managing account structure, risk controls and position sizing usually allows one to become more systematic in their process and reduce the emotional swings of fear and greed that become very costly. It pays handsomely to have a well thought out process in place. Over time, you may choose to adjust the parameters, the best funds are often evaluating and re-testing their money management settings to adjust for risk and return. I often check my stop placement, my position sizing and my overall exposure to be sure that I am not taking on more risk than I should be. These decisions are best done not on a position by position basis in the heat of the moment, but when markets are closed from an overall account perspective.