3 key data points that you need to know now, before tomorrow’s CPI. Having a well thought-out plan in place is key to making sound decisions.

1. The markets reaction to the data is more important than the data itself – at least in regard to the value of our positions.

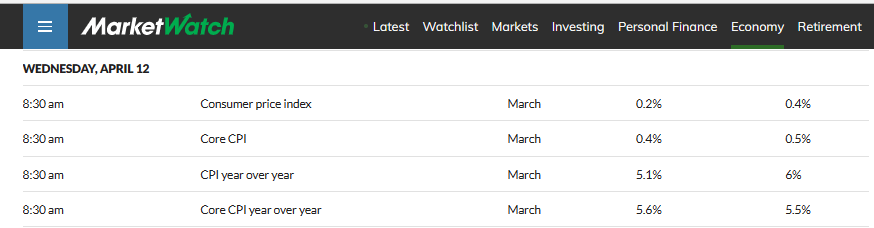

The March 2023 CPI data will be released tomorrow, at 8:30 am.

February 2023 CPI, year-over-year, was reported at 6.0%.

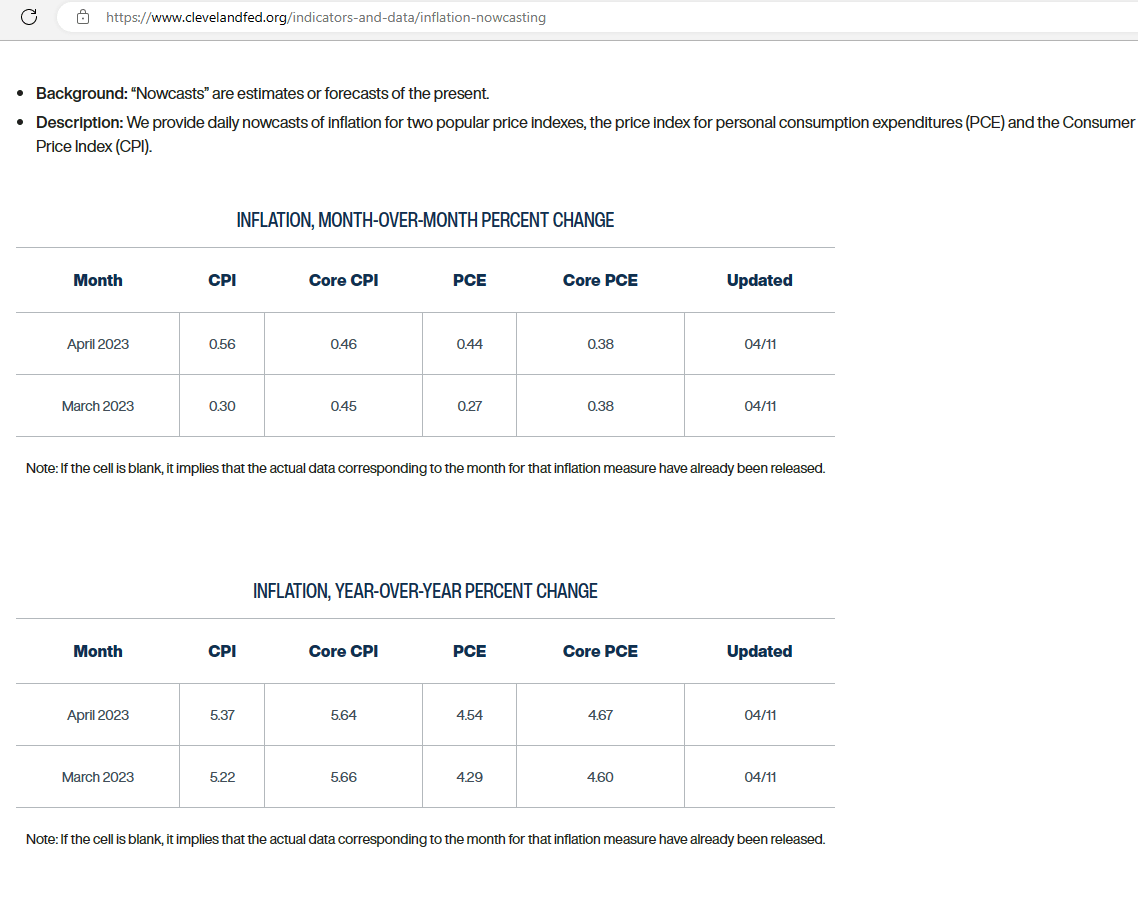

The Cleveland Federal Reserve Bank has a real-time forecast for 5.22 March CPI (YOY) for tomorrow.

CBS MarketWatch has the median forecast at 5.1. Their forecast for Core CPI (YOY) is projected at 5.5% vs 5.5% reported in February.

On the surface, these numbers look encouraging in the Fed’s quest to get inflation down.

For traders and investors, however, the most important data point will be how the markets react to the data, across stocks, bonds, currency and commodity markets.

Even if we knew the exact numbers going in, there is no way to know how the markets will react – and that determines the value of our positions.

I will be watching the CPI report tomorrow closely and more importantly how markets, leading large cap stocks and sectors react.

2. The first move isn’t always the major move.

Current markets tend to move very and react very quickly to economic data.

The initial market reaction can often be a sharp directional move, but more importantly is follow through over the next 24-72 hours.

My plan ahead of these potential high-volatility events is to have my core positions in place, but also to hold extra cash, to take advantage of any potential opportunities.

I might look to add select exposure shortly after the event, but I don’t often commit all target capital until there is some follow through.

3. Have a plan in place, don’t make quick, emotional decisions.

In high-volatility markets, traders and investors often feel the need to react right away, often based on their interpretation of the data (is it “good” or “bad”)?

The markets won’t always agree with our assessment of the data (CPI), which is why it is often a good plan to watch how the prices in markets react.

Going into potentially high-volatility events (CPI, FOMC, earnings reports), I review all stops on my open positions to be sure they are still technically valid. If I am going to raise any stops, I want to do it before the news, so that I don’t make an emotional sell decision in the initial volatility.

I keep a narrow watch list of generally 3-10 charts (stocks or ETFs), that I am looking to build or add to a position in. These are often higher relative strength charts in uptrends. I might look to add one or two of the watch-list names, based on how the charts develop. Opening buys could be smaller, and I might look for follow through. I could also take a full-sized position, or more, based on how I see the chart and reaction, plus my current exposure.

If my open positions and/or watch-list charts don’t react well, I might opt to do nothing until I can get a better read of markets over the next 24-72 hours. I want to follow the plan and not feel the need to do something just to do something.

Going in, I know what markets I am watching, what reaction variables I expect to see (in either direction) and how much I am willing to commit at any time. This applies to every day, not just news event days.

Join us now to see this week’s top 25 list and Larry’s core watch list for tomorrow: Blue Chip Daily Trend Report