START YOUR FREE 30 DAY TRIAL

In this blog and video, we review our top 6 markets calls for subscribers in 2022, with detailed and dated screenshots:

1. We sold out of high valuation growth stocks in Q4, 2021, before 50-90% declines.

2. Move into lower valuation, lower volatility, high dividend stocks and energy. (12/5/21)

3. Overweight the Energy Sector in 2022. (12/6/2021)

The Energy sector ETF (XLE) is +65% in 2022.

4. Over 50% cash, as of February 2022. (2/27/22 – present)

5. Avoid Technology Sector, May 2022. (5/1/22)

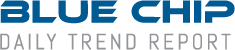

6. We Were Positioned Long Ahead of the Record Week in Commodities (2/2022)

*****

Full video: Blue Chip Daily Best Market Calls for 2022 (vimeo.com)

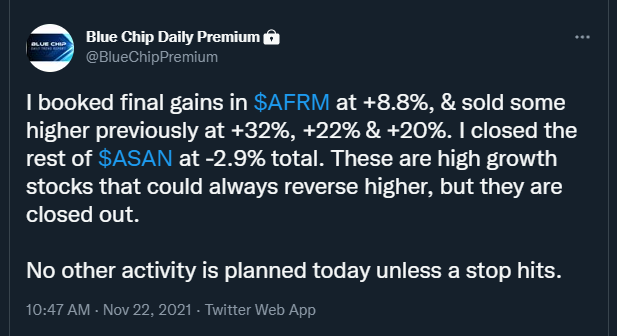

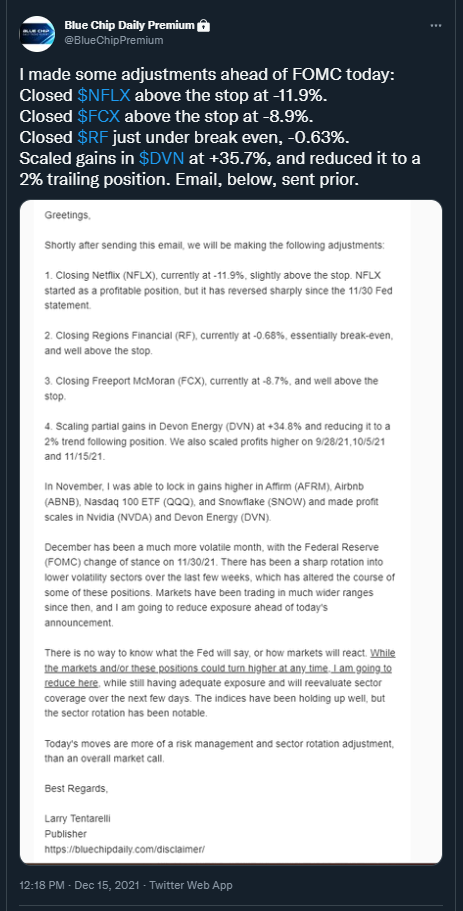

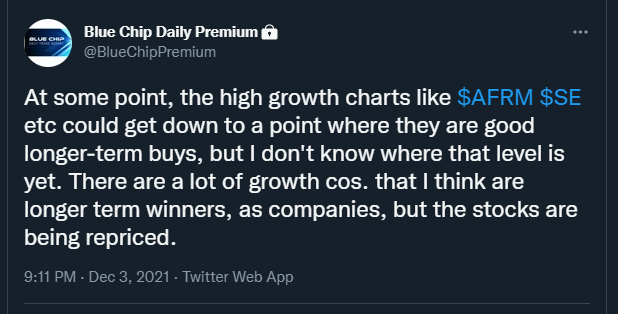

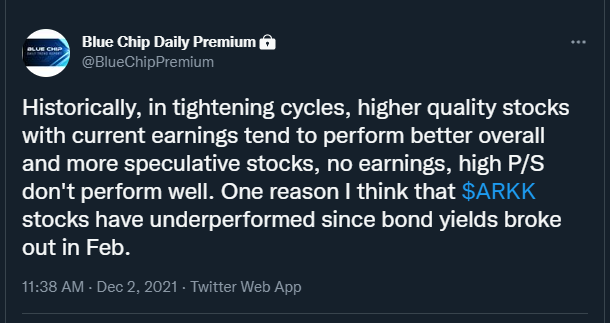

1. We sold out of high valuation growth stocks in Q4, 2021, before 50-90% declines.

High Beta Sells – Q4 2021 – Blue Chip Daily Trend Report

- We closed over 12 high growth stock positions in Q4 2021 and alerted our Members in real-time, by email, on our premium Twitter page and in our daily markets videos.

- We informed Members that we were not adding to any of these stocks on the way down and that they will likely underperform in the FOMC tightening cycle.

- We sold Netflix (NFLX) on 12/15/21 and avoided a 72% decline.

- We sold Sea Limited (SE) on 12/1/21 and avoided an 80% decline.

- We sold Roblox (RBLX) on 12/15/21 and avoided a 77% decline.

- We sold Facebook (FB) on 12/1/21 and avoided a 46% decline.

- We sold Amazon (AMZN) on 10/29/21 and avoided a 36% decline.

- We sold Affirm Holdings (AFRM) on 11/22/21 and avoided a 90% decline.

- We have avoided trying to buy any of these stocks in 2022 and especially the higher valuation stocks with no earnings.

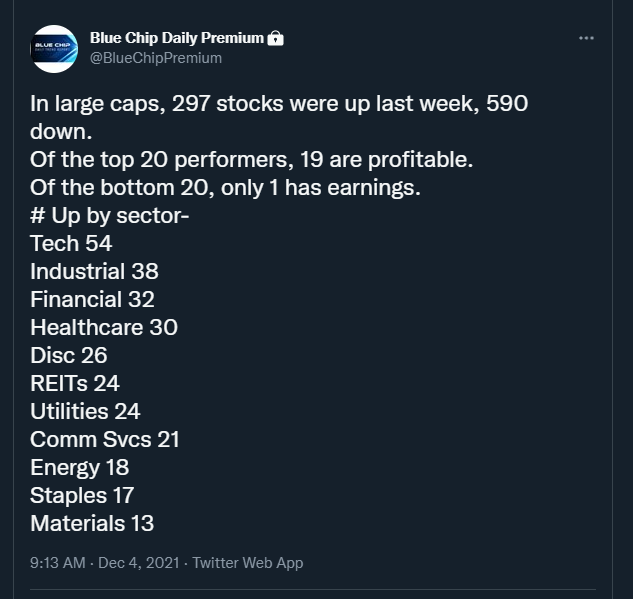

2. Move into lower valuation, lower volatility, high dividend stocks and energy. (12/5/21)

- On 12/5/21, we published a special Members only blog and video, and discussed past FOMC tightening cycles and what we expected for this one.

- Three key takeaways:

- High valuation stocks with no earnings should underperform and be avoided.

- Lower valuation, lower volatility, higher quality stocks with dividends should outperform.

- Energy should outperform.

- OUTCOME:

- Growth stocks have had a record unwind in 2022.

- Lower valuation, lower volatility, higher quality stocks with dividends have outperformed.

- Energy is the top S&P sector YTD, at +47%. SPY is -17%.

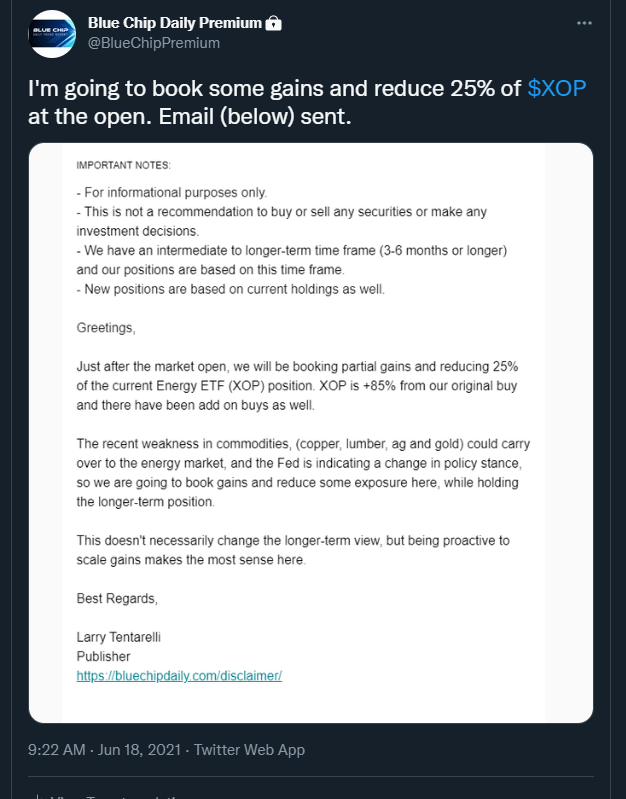

3. Overweight the Energy Sector in 2022. (12/6/2021)

The Energy sector ETF (XLE) is +65% in 2022.

Our open Devon Energy (DVN) long position is currently +145%. We have scaled some gains along the way and moved up the stop.

Our open Chevron (CVX) long position is currently +41%. We have scaled some gains along the way and moved up the stop.

We opened a long position in Energy ETF (XOP) in Q4 2020 and booked 41% – 85% position gains.

4. Over 50% cash, as of February 2022. (2/27/22 – present)

This has been an exceptional value add, greatly reducing drawdown and volatility.

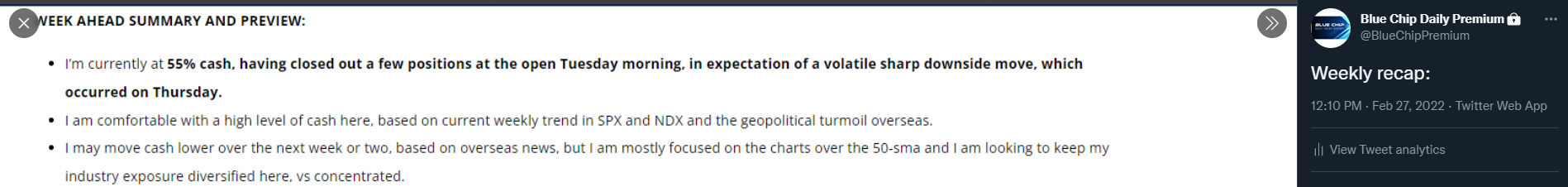

WEEKLY RECAP 2/27/22, CASH AT 55%

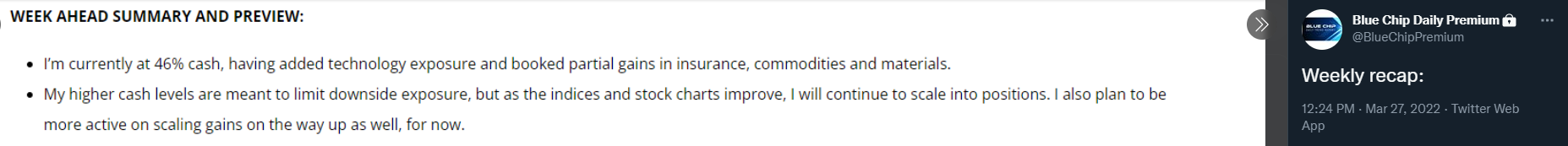

WEEKLY RECAP 3/27/22, CASH AT 46%

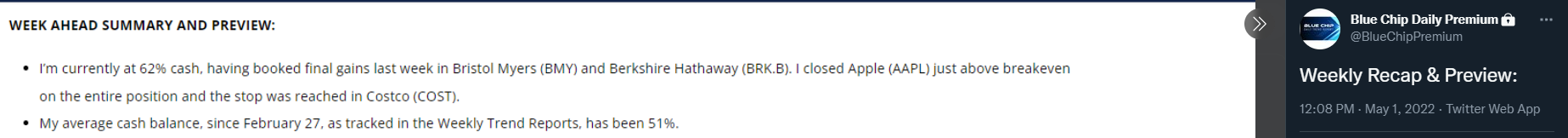

WEEKLY RECAP, 5/1/22, CASH AT 62%

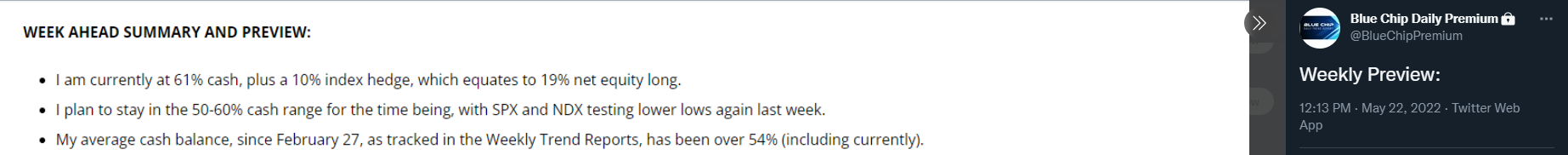

WEEKLY RECAP 5/22/22, CASH AT 61%

5. Avoid Technology Sector, May 2022. (5/1/22)

Nasdaq 100 ETF (QQQ) has had a 10.5% drawdown in May 2022, so far.

6. We Were Positioned Long Ahead of the Record Week in Commodities (2/2022)

Commodities Had a Record Week – Blue Chip Daily Members Were Positioned Ahead of the Breakout – Blue Chip Daily Trend Report