– Learn How You Should Be Positioned Right Now, to Protect Capital and Profit, Regardless of Which Way Markets Go.

– Get FULL Member Benefits:

– Real-Time Trade Alerts, on BOTH sides of the Market.

– Members Only Private Twitter Access.

– Weekly Best Stock and ETF Ideas Buy/Sell List.

– Weekly High Beta List for Active Trades and Options Traders.

– Daily Markets Videos.

– Get Larry’s Daily Insights on Technical and Trend Analysis

– Start Your 30-day Free Trial, Below.

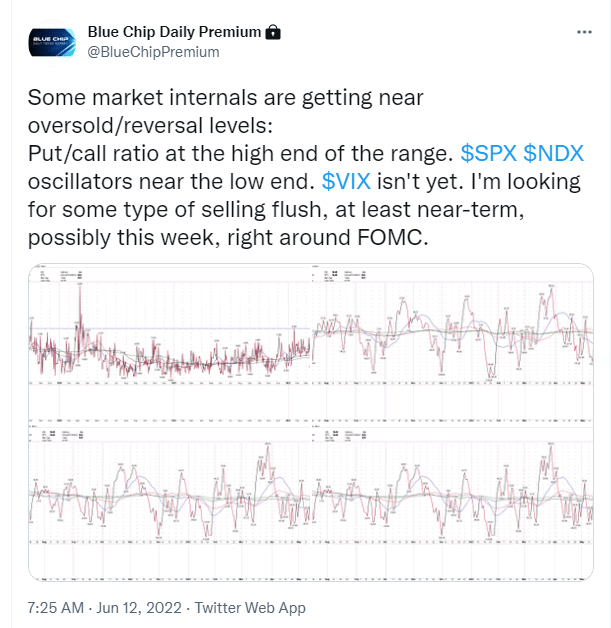

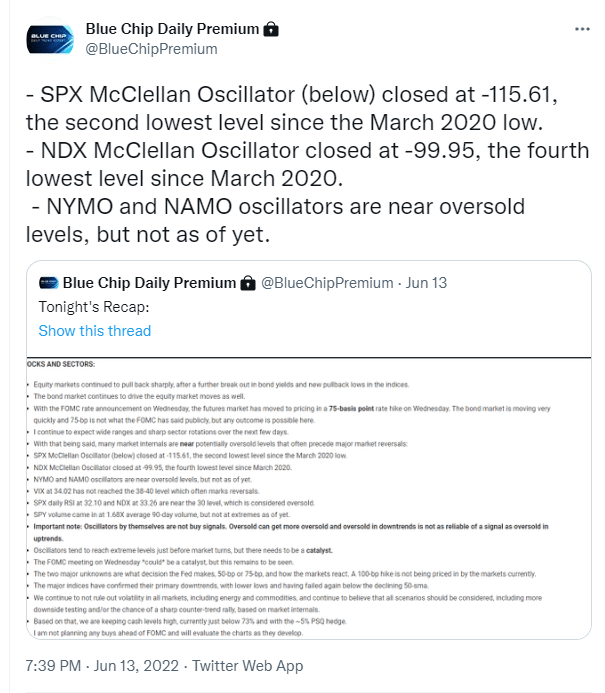

On June 12, 2022, Larry informed our subscribers that the S&P 500 was at a very oversold level and to expect a reversal higher after that week’s FOMC meeting.

The S&P 500 put in the low for the year that week, two days after the FOMC meeting.

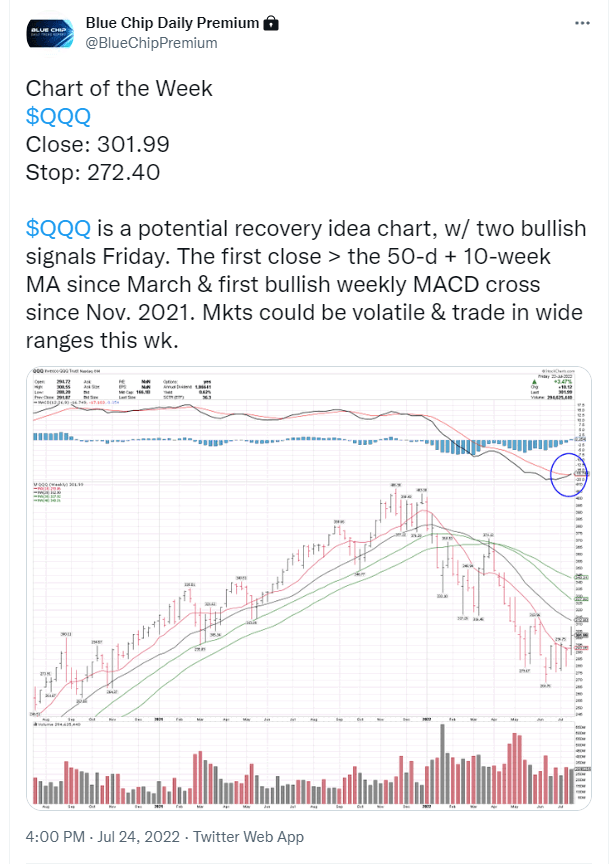

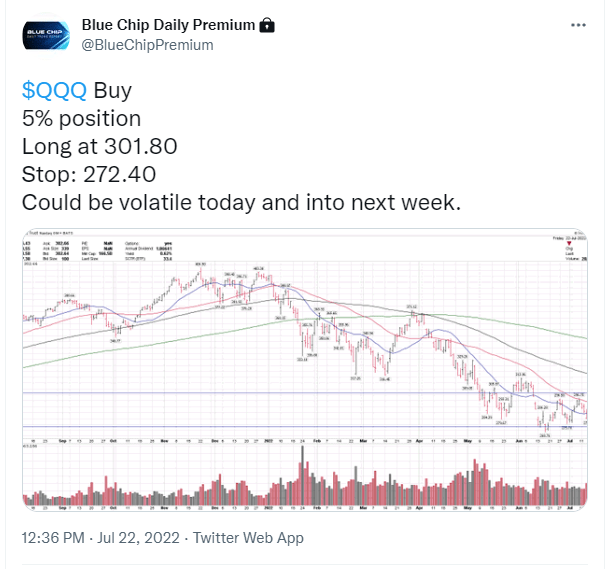

On July 24, Larry informed our subscribers that the Nasdaq 100 ETF (QQQ) had two bullish price signals and that he was taking a long position.

(QQQ) went on to a +10% gain over the next 3 weeks.

Starting in November 2021, we alerted subscribers that we were booking gains and closing out growth stocks such as Facebook, Netflix, Snowflake, and Sea Limited, among others, before 50-70%+ declines.

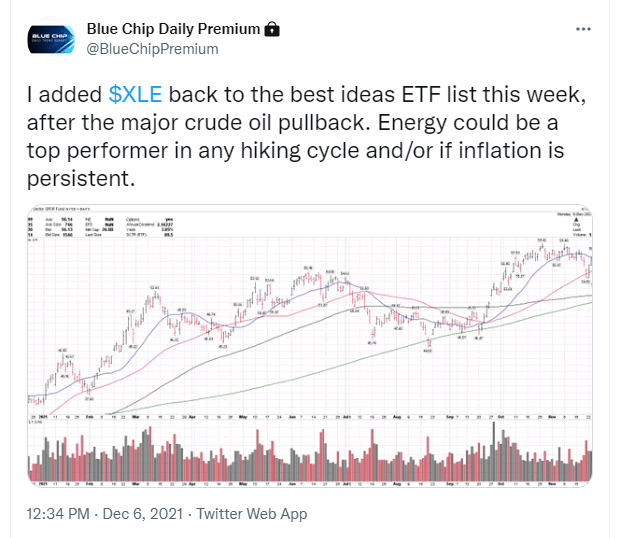

We started buying into the energy sector in November 2020, and in December 2021 we made it a top idea going into 2022. Energy sector ETF (XLE) is +44% year-to-date.

After 30-days, you will be welcomed to extend your subscription to the monthly ($59/month) or annual ($599/year $499 limited time offer!) package.

Get started with the 30-day free trial today! There is no obligation to renew and you can cancel at ANY time.

Please note, this free trial offer is only available to first time subscribers.

This site uses functional cookies and external scripts to improve your experience.

Privacy settings

Privacy Settings

This site uses functional cookies and external scripts to improve your experience. Which cookies and scripts are used and how they impact your visit is specified on the left. You may change your settings at any time. Your choices will not impact your visit.

NOTE: These settings will only apply to the browser and device you are currently using.

Cookies

We use cookies to make Blue Chip Daily’s website a better experience. Cookies help to provide a more personalized experience and web analytics for us. Click here to view our Privacy Policy and Terms and Conditions.