**Updated on 1/7/23.

- In our 2023 investing Guide we published 12 investment ideas, in 5 different markets/sectors.

- For the first week of 2023, the top idea was up by over 14%.

- 3 of the 12 ideas were up by 10% or more.

- 5 were up by 5% or more.

- 11 of 12 were higher for the week.

- 8 of the 12 outperformed the S&P 500 index.

- The one idea that was down for the week, was down by -0.13%.

- The year is just getting started and there could be more follow through to these ideas over the course of 2023.

Our 2023 Investing Guide with our markets outlook and Top 5 ideas for 2023 has just been released. It includes an 18-page PDF report, 16 charts and video.

Our top 3 market calls of 2022, from our Investing Guide published on 12/5/21, were to:

- buy energy

- buy value over growth

- sell high beta growth at the end of 2021

(real-time screenshots below).

Our 2023 Investing Guide has just been published and released.

This is an 18-page PDF report, also 16 charts, plus a 30-minute video which outlines:

1. Our Top 5 Investing Ideas for 2023

2. Best Ideas to be positioned for a slowdown or recession

3. Best Ideas for high-volatility markets

4. Our top ranked market sectors

5. Our view on the Nasdaq 100 mega-cap leaders

6. Stocks, sectors and industry groups that we are avoiding into 2023

7. Our detailed, base case views on the U.S. economy in 2023, the S&P 500 index and on the Fed tightening cycle

- With the financial news media running reports 24/7, with often completely opposing predictions about the economy and markets over the next 12-months, we have put together a clear, concise and easy to follow view of our best insights going into 2023.

- This is a comprehensive view of not only the stock market, but also the bond market, precious metals, select commodity groups and select overseas markets.

- Our 2023 Investing Guide is 18 pages, filled with up-to-date actionable research, data and ideas, with 16 charts and a 30-minute video as well.

**Annual membership subscribers will get the 2023 Investing Guide, full access, at no extra charge.**

Highlights from our 2022 Investing Guide, published on 12/5/21:

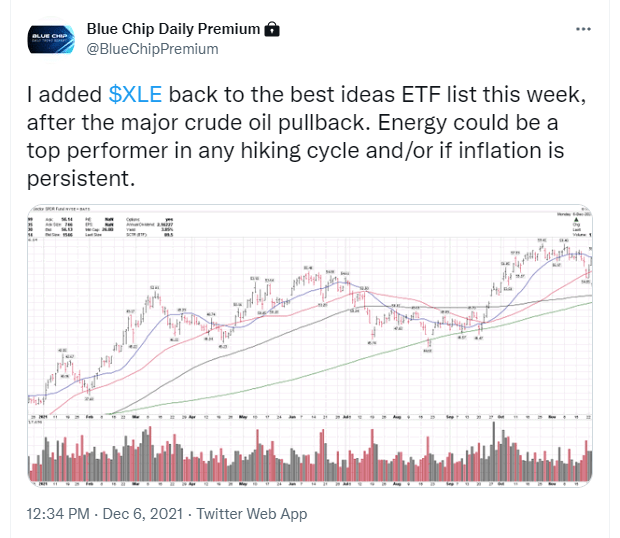

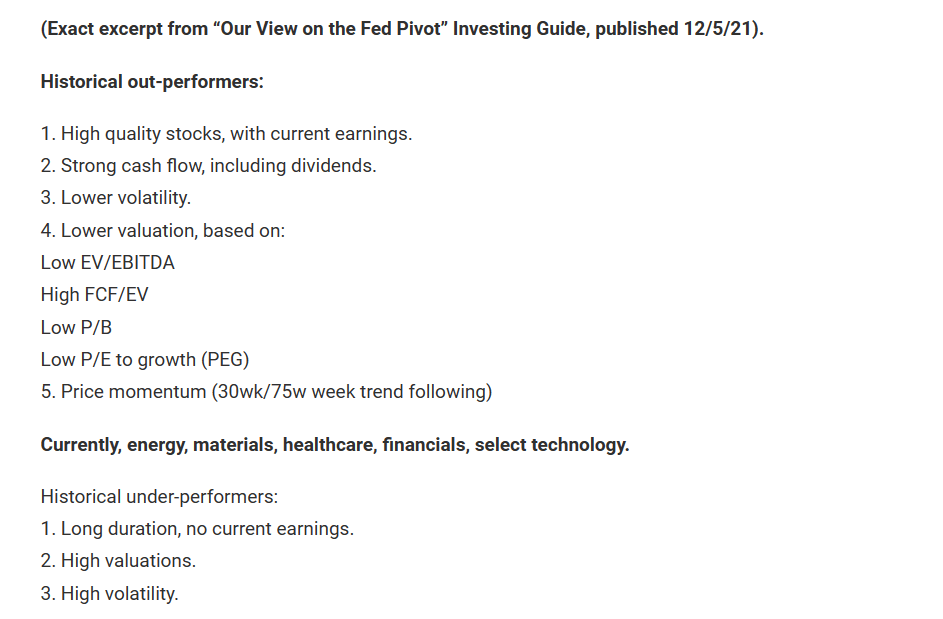

1. We expect the energy sector to be a top performer in 2022. Follow up: The energy sector ETF (XLE) has been the top performing sector in the S&P 500 in 2022, and is presently +50% year-to-date.

Energy sector post, 12/6/21. (XLE) is up by over 50% in 2022.

2. We expect lower-volatility stocks to outperform and higher-volatility growth stocks to underperform. Follow up: The S&P 500 low volatility ETF has outperformed the higher

volatility Nasdaq 100 ETF by 2300-basis points this year, or 23 percentage points.

3. We sold our positions in Netflix (NFLX) and Meta Platforms (META), formerly Facebook, in the 4th quarter of 2021. Follow up: Both Netflix and Meta both went on to over 50% declines after we sold our positions.

Posts shared in the 4th Quarter of 2021, where we closed out high beta tech positions and were looking to eliminate exposure to that higher-volatility group. Many of the growth stocks that we sold in late 2021, dropped by 50-70% in 2022.

About the Author:

Larry Tentarelli is the President and Founder of the Blue Chip Daily Trend Report.

- Larry has been actively involved in markets as a trader and investor since 1998 and was an advisor with Merrill Lynch for 5 years, before making the move to manage and trade his own accounts. Larry also passed the FINRA series 65 exam in December 2019. Larry has been posting his market commentary, technical views, and stock and ETF ideas on Twitter since January 2013, and currently has a following of over 81,000 people, including:

CNBC

Bloomberg

Barron’s

Investors Business Daily

the CME

and many investment advisors, fund managers and financial journalists.

- Larry has been named “One of the Top 50 Twitter accounts for investors to follow” by CBS Marketwatch and one of the “Most Helpful Traders on Twitter”, in a broad-based Twitter poll. Larry has also been interviewed by the CME, and a guest on a variety of financial podcasts, as a guest contributor for CBS Marketwatch, and Stockcharts.com and quoted in the book “Trend

Following”.

Terms and conditions: Due to the timeliness of this information, all sales are final. There are no refunds.

Full disclaimers: Disclaimer – Blue Chip Daily Trend Report

Data as of 12/19/22.